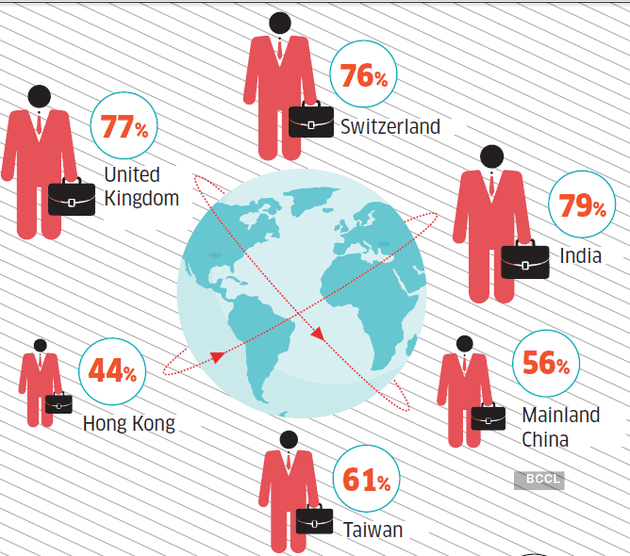

Most want to pass the baton to kin

Business owners all over the world have different succession plans. While some prefer to sell their businesses, most entrepreneurs intend to pass it on to a family member.

Inter-generational wealth transfer in India

Family-owned businesses in the country are taking a proactive approach towards transition of wealth and succession planning.

- Financial advice, risk mitigation, wealth management are being integrated into this process.

- Many businesses, established in the 1990s following economic liberalisation, have second-generation entrepreneurs educated abroad and raised in cosmopolitan settings.

- Multi-generational family businesses accord a high value to extended family and kinship, with some thriving for over a century.

Entrepreneurs who are hesitant to seek support from older generations

7% Indian heirs feel obligated to join the family business.

83% Next-gen Indians who felt confident about pursuing other interests when they first took over the family business.

$5.8tn Inter-generational wealth transfer expected within Asia Pacific from 2023 to 2030, according to McKinsey, with ultra-high networth individuals (UNHIs) accounting for 60%.

Among Indian entrepreneurs…

~79% is the contribution of familyowned businesses to India’s GDP, one of the highest ratios globally.

334 Billionaires (US $) in India in 2024, up 29% year-on-year, as per Hurun data, of whom…

~70% set to receive $1.5 trillion intergenerational wealth, which is more than one-third of India’s GDP.

Source: HSBC Global Private Banking ‘Family-owned businesses in Asia: Harmony through succession planning 2025’ report. The research was conducted by Ipsos UK on behalf of HSBC among 1,798 high net-worth business owners with at least $2 million investible assets. It was conducted online in mainland China, France, Hong Kong, India, Singapore, Switzerland, Taiwan, UAE, UK and the US.