“While earlier tax deductions justified holding on to loans, the new tax structure weakens that logic as the cost has gone up,” says Amar Ranu, Head- Investment Product & Insights, Anand Rathi Shares and Stock brokers. This makes it a good time to reassess your repayment strategy and consider prepaying to reduce the overall interest outgo.

Why prepaying works

Home loans follow a front-loaded structure— in the early years, a larger portion of your EMI goes toward interest rather than principal. When you prepay, the outstanding principal comes down, and with it, the future interest liability. Even modest prepayments can lead to a sizeable reduction in the total interest paid and loan tenure.

Take a standard Rs.50 lakh loan at 8.5% for 20 years. Over this period, you’d pay over Rs.48 lakh in interest alone, almost the same as the amount borrowed. A one-time prepayment of Rs.5 lakh in the third year can shorten your loan term by 3-4 years and reduce your interest burden by Rs.10-12 lakh, depending on your lender’s terms. The earlier you prepay, the more you save.

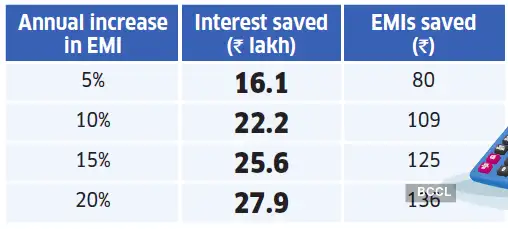

If lump sum prepayments aren’t feasible for you, increasing EMI every year as your income grows is a practical alternative. Raising your EMI by 5-10% annually has a similar effect on your interest savings and tenure.

How many EMIs can you save by prepaying a loan?

If you borrow a loan of Rs.50 lakh for 20 years @8.5%, you will pay a total of 220 EMIs.

For instance, increasing your EMI by 10% every year on a 20-year loan can bring down your repayment period to under 10 years, while reducing your total interest paid by nearly 45%. Even a 5% annual step-up can help you repay the loan in 12-13 years instead of 20 (see table). This gradual strategy suits younger borrowers who cannot commit to a short tenure from the beginning but still want to reduce their debt burden early.

The most effective repayment strategy is a combination of periodic lump sum prepayments and annual EMI hikes. This dual approach not only accelerates debt reduction but also leads to significant interest savings. You cut your loan tenure nearly in half and end up paying far less in interest without compromising your lifestyle.

Utilise unattractive assets

Prepayment doesn’t necessarily require big sacrifices. You can start by redirecting windfalls like bonuses, maturing FDs, maturity proceeds from traditional life insurance products or even proceeds from the sale of low-return assets. Setting aside a portion of your annual increment or incentive can also build a healthy prepayment pool over time.

The key is consistency. Setting a goal, such as prepaying 5% of the loan amount every year can help you stay disciplined and make steady progress without straining your budget. But remember that prepaying in the early years of the loan makes the most financial sense. This is when the interest component of your EMI is at its peak, and reducing the principal early translates to substantial interest savings over the remainder of the tenure.

As your loan progresses, a larger share of the EMI goes toward repaying the principal. So, if you’re already in the 15th year of a 20 year loan, the benefit of prepaying is minimal in comparison to the early years. “Continuing the loan may also be better if the interest rate is low (e.g., 7.35%), or you have better investment avenues yielding 10%+,” adds Ranu.

However, considering the volatility in markets, prepaying a home loan can be a more sensible use of surplus funds. Market investments may offer potentially higher returns, but they also carry risk. On the other hand, prepayment guarantees savings in the form of reduced interest payments, something that’s fixed and risk-free.

Vipul Patel, Founder of mortgage-world. in explains, “Prepaying your loan is like saving money at the same rate as your loan interest. So, if your home loan rate is 8.5%, every rupee you prepay helps you avoid paying 8.5% interest on it, which is as good as getting a risk-free return of 8.5%”. That’s more than what most safe investments offer right now. And a non-monetary benefit is peace of mind when you pay off your loan earlier than decided. Remember that most banks now allow prepayments on floating-rate loans but it’s still wise to doublecheck for any hidden charges or processing conditions. Also, maintain adequate liquidity. You shouldn’t compromise your emergency fund or ongoing investments in the process. A healthy financial buffer should be in place before you start channelling excess cash into loan prepayment.