The power of mix: why portfolios need more than just equities

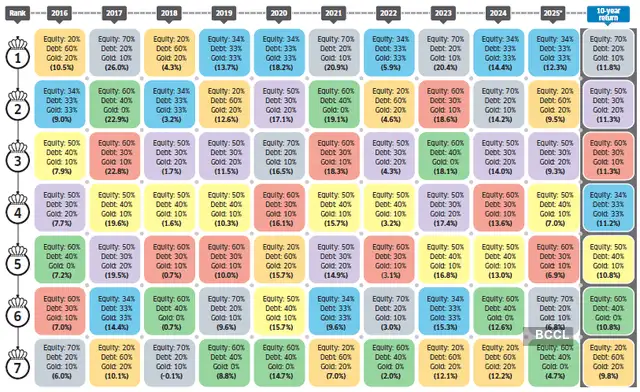

The portfolio with a heavy equity weight (70% equity) has underperformed in 2025 so far due to high volatility driven by global uncertainties, demand growth challenges, and concerns about corporate India’s earnings growth. However, over the long term, equities have outperformed both debt and gold.

Conversely, the debt-heavy portfolio (with a 60% allocation) has performed well in 2025 so far but ranked at the bottom over the long run. Additionally, its performance has seen high volatility since 2020.

Gold has become a crucial asset. The portfolio with no gold exposure remained among the two biggest underperforming portfolios for six years between 2015 and 2025. The significance of gold is also evident in the long run. A portfolio without any gold is the second-worst performer over the last 10 years. Low correlation with equities, hedge against inflation, and safe-haven status make gold a key asset for managing investment volatility.

Though the equal-weighted portfolio has been the top performer so far in 2025, its performance was modest in the long run.

Source: ACE MF. *2025 data is YTD based on 15 July 2025 closing values. Other years’ returns are calculated between the first and the last trading day closing values. Numbers in brackets are the weighted average returns (or portfolio returns) of the respective investment allocations. The 10-year weighted average return is based on compounded returns of the respective assets, calculated between 15 July 2015 and 15 July 2025. Benchmarks used: Equity: Nifty 500 Index, Debt: Crisil Composite Bond Index, Gold: Nippon India ETF Gold BeES