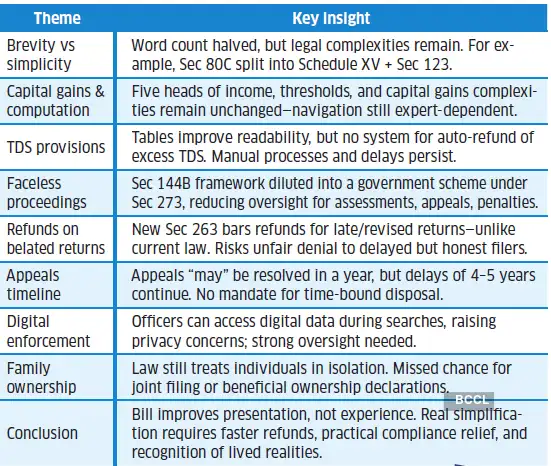

This brevity is welcome, but the real question is: has the law become easier to comply with, or just easier to read? For most salaried individuals, pensioners, HUFs, and small businesses—the bulk of India’s taxpayers— clean language alone isn’t enough. They seek a system that’s truly easier: fewer hurdles, faster resolutions, and fairer treatment. Let’s explore certain key areas that reveal the difference between surface-level simplification and real compliance ease.

1. Plain in language, but legally?

The Bill does try to replace certain complicated legal jargons with easier-to-understand English counterparts. It replaces the confusing dual year concepts of ‘assessment year’ and ‘previous year’ with a uniform ‘tax year’. Similarly, ‘notwithstanding anything’ makes way for the simpler phrase ‘irrespective of’. However, the Bill does little to demystify these provisions for average taxpayers.

The brevity is mainly due to smart formatting. Long subsections, provisos and explanations have been recast into separate schedules and tables. While it improves readability, core legal complexities remain: e.g., bulky clauses of eligible saving and investment avenues in Section 80C of the existing Act are now part of Schedule XV, with a shorter main provision under Section 123 in the Bill—thus streamlining form, not substance.

The Bill retains the substantive core of the existing Act. The five heads of income remain unchanged, as does the computational architecture. Key reliefs and thresholds, including the `12-lakh exemption in the new tax regime, are still there. This ensures continuity but also retains historical complexities. Areas like capital gains, holding periods, asset classification, overlapping exemptions under sections 54, 54EC, 54F, and fair market value (FMV) rules are untouched and navigating them demands expertise.

2. Tedious TDS compliance

The new tabular layout for tax deduction at source (TDS) provisions—listing rates, thresholds, and deductee types—reduces confusion, but procedural pain points persist. Refunds of excess TDS mistakenly deducted and deposited by deductors still require manual follow-up, suffer delays, and lack transparency. The Bill misses an opportunity to mandate automatic system-driven refunds for over-deductions.In the current Act, Section 144B outlines faceless assessment in legislative detail.

But the new Bill relegates this whole framework to executive rule-making under Section 273. By making it a government-notified scheme instead of embedding it in the law, the Bill lowers parliamentary oversight. It may offer administrative flexibility but dilutes legislative sanctity and taxpayer protection. Faceless reassessments, appeals and penalty proceedings are similarly diluted, raising worries on transparency and legal sanctity.

4. Belated returns & refund panic

While Section 263 of the Bill, corresponding to Section 139 of the Act, mandates return filing by specified taxpayers on or before due date, it also adds a new category—any person seeking to claim a refund must now file their return by the due date. This requirement has no parallel in Section 139 of the current Act.

Section 239 of the current law allows refund claims through any return filed as per Section 139, including belated or revised returns. In the new Bill, Section 263(1)(a)(ix) disqualifies returns filed after the due date from claiming refunds, thus barring belated or revised returns from claiming refunds. Unless clarified or amended, this provision is a regressive departure and risks unfairly denying refunds to honest but delayed filers.

Taking cognizance of this, the Select Committee has reportedly recommended for the deletion of this clause.

5. Delay in appeals continues

Under both laws, the Commissioner of Income Tax (Appeals) “may” dispose of appeals within a year. In reality, it often takes 4-5 years. Refunds get stuck, and justice is delayed. The current draft of the Bill does not make this timeline mandatory.While strengthening enforcement by authorising access to digital footprint, cloud data, and personal devices, the Bill raises privacy concerns. Strong oversight and clear limits must check the powers given.

7. Family ownership

Families today often share ownership and income. But the tax law still treats each individual in isolation, leading to misattributed income or unwanted clubbing. The Bill missed an opportunity to allow for declaration-based beneficial ownership or joint filings. While enforcement adapts to the digital era, compliance is stuck in the past.

True simplification must entail easier TDS compliances and regime choices, faster refunds, timely appeals, privacy safeguards, and rules reflect real financial lives. Until these changes follow, the burden on honest taxpayers may remain largely unchanged.

The Auhtor is FOUNDER, TAXAARAM INDIA AND PARTNER, SM MOHANKA & ASSOCIATES