Under the Motor Vehicles Act (MVA), 1988, TPI is mandatory for all cars and two-wheelers in India. Despite this, many motorists continue to skip the cover. In 2023, the Minister of State for Finance, Bhagwat Karad, revealed that more than 50% of vehicles on Indian roads were operating without the mandatory insurance. That’s not just a violation of the law but also exposes drivers and victims to avoidable hardships.

What does it cover?

TPI is designed to protect others from the financial consequences of your actions on the road. In simple terms, it covers injuries or death of another person caused by your vehicle, as well as damage to someone else’s property, such as another car, motorcycle, or roadside structure.

It is important to note that TPI does not cover damage to your vehicle or your medical expenses.

This is where comprehensive car insurance comes in. TPI is often complementary to comprehensive policies, which combine coverage for your own losses with the mandatory third-party liability.

The cost differs depending on the vehicle and its use. For cars, it covers liabilities arising from accidents affecting other people or their property. Two-wheeler TPI provides similar protection but at a lower premium.

Reasons to avoid

Everyone has different reasons for avoiding insurance. Some find it too cost too high, while others are overly confident about their driving skills.

Take the case of Delhi-based Suprita Pal, who purchased a car in 2021. She paid for insurance during the first three years but chose not to renew it in 2025. She believes she doesn’t need insurance because she drives carefully. “I never met with an accident in the first three years and didn’t have to claim anything,” she says, calling the premium a waste of money. Still, Pal is aware of the legal requirements and now plans to switch to just a third-party cover instead of the comprehensive plan she once had. Her realisation came after being slapped with a hefty fine for driving without insurance. “I wasn’t aware that it was mandatory,” she admits.

Pal’s situation is not unique. Many drivers are willing to splurge on the car but cut corners when it comes to insuring it. Paying a fine is one obvious risk. “If any person drives in contravention of Section 146, then he/she can be punished with imprisonment of up to three months or a fine of up to Rs.1,000, or both,” explains Apeksha Lodha, Partner, Singhania & Co. But the bigger danger lies elsewhere: if you cause an accident, the financial liability can be far more crippling.

We have broken down the scenarios into three parts:

Suprita Pal,New Delhi

Car: Volkswagen Polo

Driving since 2021

Insured? No

Fine paid: Rs.1,500

Note:“I never met with an accident and didn’t have to claim anything. Insurance for me is useless.”

Legal consequences

If you hit a pedestrian

Even if it was the pedestrian’s fault, you will have to pay the compensation decided by the court. Lodha explains how the injured person’s liability will be calculated before the Motor Accident Claims Tribunal (MACT) under Section 179 of the MVA. The tribunal adjudicates claims for compensation arising from accidents that result in death, injury, or property damage.

“In absence of TPI, the driver will be personally liable to compensate the injured person for pecuniary damages such as medical expense, loss of income, in case the ability to earn in future is affected of the injured, besides loss of future earning capacity and non-pecuniary damages such as compensation for pain and suffering, or for any temporary or permanent disability,” she says.

The driver can also be prosecuted under criminal law for rash driving, causing grievous hurt.

Imagine: Rahul hits a pedestrian who suffers a broken leg and misses 2 months of work.

- Medical expenses:Rs.50,000

- Loss of income: 2 months’ salary = Rs.40,000 × 2 = Rs.80,000

- Pain and suffering: Court decides Rs.30,000

- Total compensation: Rs.50,000 + Rs.80,000 + Rs.30,000 = Rs.1,60,000

If pedestrian dies

If the accident leads to death, civil as well as criminal legal action can be taken against the driver. Drivers can be prosecuted under Bharatiya Nyaya Sanhita (India’s new criminal law). The driver can be charged with causing death by negligence under Section 106-which applies when death happens because the driver was careless¡Xor with culpable homicide not amounting to murder under Section 105, which applies when the act was severe enough to cause death but was not intentional murder.

The family of the deceased can file a civil claim for compensation under Section 179 of MVA. Compensation will include loss of future earnings, loss of consortium, funeral expenses, loss of estate, pain and suffering.

Imagine: Priya accidentally hits a pedestrian who dies. The person earned Rs.10 lakh/year and was expected to work for 25 more years.

Loss of future earnings: Rs.10,00,000 * 25 = Rs.2.5 crore

Loss of consortium (family support): Court assigns Rs 10 lakh

Funeral expenses: Rs.2 lakh

Pain and suffering: Rs.5 lakh

Total compensation: Rs.2.5 crore + Rs.10 lakh + Rs.2 lakh + Rs.5 lakh = Rs.2.67 crore

Accident with another vehicle

If you meet with an accident and the fault is yours, you will be liable to compensate the other person for repairs and other damages from your pocket in case you don’t have insurance. The liability is calculated similarly to the first case.

Imagine: Aman rear-ends another car. The repair bill is Rs.80,000, the other driver had minor injuries costing Rs.20,000 in medical bills, and he lost one month’s salary Rs.35,000.

Total compensation: Rs.80,000 + Rs.20,000 + Rs.35,000 = Rs.1,35,000

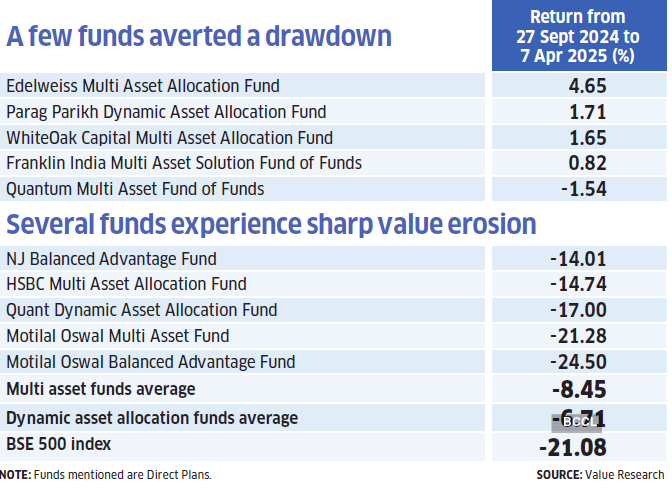

What’s covered (what’s not)

Third-party insurance doesn’t cover personal damages. Comprehensive car cover is still important where TPI is complementary.

The road, however, is bumpy

One of the reasons people shy away from insurance is the fear of long and tedious claim settlements. Many assume that cases take years to conclude in court — in some situations, especially those involving fatalities, this is true. “It’s common for cases to take years to reach a final settlement. This is primarily due to the nature of the accident, parties involved, the claim amount, procedural delays, and the investigation process,” says Shashank Agarwal, Founder, Legum Solis.

Delays are more common in hit-and-run cases, as they require a detailed investigation. This discourages many from buying TPI, leading them to believe it is a waste of money. However, a delay would occur any way. With a TPI, you won’t at least bear the cost of the lawsuit.

Long process, low cost

The process is not as burdensome as many think. Raadhika Chawla, Advocate, Delhi High Court, explains that if the insurance company determines that compensation is payable and makes an offer, and the claimant (driver) accepts, the parties appear before MACT for judicial approval. If the claimant rejects the offer, the tribunal then hears the case in detail. Another common misconception is that claimants must spend years in court and pay hefty legal fees. “The insurance company handles the process and appoints its own lawyers to represent the matter before the tribunal. The insured does not need to hire a separate lawyer, nor does the government provide one,” adds Chawla. Once documents are verified, the insurer pays compensation directly to the victim.

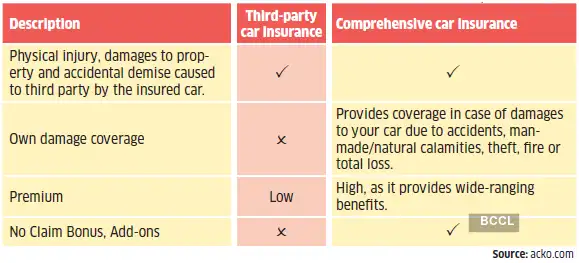

Premiums for cars and two-wheelers

Rates not been changed since 2021 but are expected to rise by 10% this year.

How compensation is decided

The type and timing of compensation depend on the section of the MVA under which a case is filed. In serious accidents, families may receive interim compensation under ‘no-fault liability’ provisions, typically paid by the insurer without waiting for the final verdict. For final awards, the MACT applies formulas approved by the Supreme Court which factor in the victim’s age, monthly income, dependents, and future earning potential. In injury cases, the tribunal considers the degree of disability, medical costs, and loss of earning capacity. Importantly, with third-party insurance in place, it is the insurer—not the driver— who pays once the liability is established.

Essential, not optional

“What makes TPI most useful is that there is no cap on the liability. So even if your liability exceeds several crores, the insurance company will have to pay it,” says Paras Pasricha, Head-Motor Insurance, Policybazaar.com. He explains that the only cap in third-party cover is for property damage, which is restricted to Rs.7.5 lakh.

However, note that the company may not be liable to pay if you’re proven to be guilty of drunk driving or your license has expired. The final judgment is given by the court, though. Yes, the process can feel slow, but third-party insurance ensures that you don’t pay lakhs out of your own pocket. It is not only a legal mandate but also a financial safeguard that protects you from life-altering liabilities. It is the cheapest financial shield you can buy. Ignoring it is like driving without brakes.