The Kerala High Court (case no. 2025:KER:53846) said: “It is trite that the employer cannot contribute retrospectively to the pension fund more than statutory limits just to derive benefits which were not available to the members when the contribution was limited to statutory wages.”

Summary of the judgement

Vinay Joy, Partner at Khaitan & Co, said to ET Wealth Online: This case arose in the backdrop of the EPFO allowing voluntary higher contributions to the provident fund and the pension fund (collectively, “PF Contributions”) to be made on an employee’s actual higher wages, and not limited to the statutory wage ceiling.

In this case, the employer had made PF Contributions for a certain period calculated only on the statutory wage limit. However, after the employees had retired, the employer and the retired employees requested the EPFO to retrospectively accept the differential between the contributions made on the statutory limit and those calculated on actual higher wages, along with interest, for the said period, so as to enable the retired employees to receive a higher pension.

In this context, the question before the Kerala High Court was whether the EPFO could be directed to accept such retrospective higher PF Contributions from the employer, particularly where such differential had neither been determined as a shortfall nor demanded by the EPFO .

The Court answered this question in the negative for the following reasons:

(a) The retired employees and the employer had not exercised the joint option in the prescribed manner for payment of PF Contributions on actual higher wages, nor had they in fact paid employee PF Contributions on such actual higher wages during the period of employment.

(b) At the time the request for higher PF Contributions was made, the individuals concerned had ceased to be “employees” (as they have retired).

(c) The retired employees had accepted their provident fund and pension benefits as per their entitlement without protest.

(d) The Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 (“EPF Act”) does not contemplate accepting retrospective PF Contributions, given that the EPFO’s funds are operated on an actuarial basis.

(e) Any shortfall in the employer’s PF Contributions cannot be accepted by the EPFO without first being determined in accordance with Section 7A (Determination of moneys due from employers) of the EPF Act.

Joy says: “This judgment underscores the importance of the timely exercise of the joint option by both the employer and the employees where they intend to make provident fund contributions on actual higher wages rather than the statutory wage limit. Any delay in exercising such joint option may prove to be prejudicial of the employees.”

Also read: Higher EPS pension for EPF members allowed by Punjab & Haryana High Court for pre-2014 retired employees with these three conditions

Background of the case

67 employees of the Cochin International Airport Authority (CIAL), a public limited company, are covered under the Employees Provident Funds and Miscellaneous Provisions Act, 1952 (EPF Act) and the Employees Pension Scheme, 1995.

From 1995 to 2003, CIAL contributed to the provident fund based on the statutory limits (Rs 15,000) rather than the actual salaries of the employees involved.

Later on, CIAL submitted several representations between November 15, 2018 and January 7, 2020, expressing its willingness to make retrospective contribution to the provident fund based on actual salaries.

Additionally, CIAL requested the Regional Provident Fund Commissioner (appellant No.2) to process the higher pension claims of their retired employees and approve a higher pension for them.

CIAL claimed that EPFO ignored its specific request, leading to a court case.

In response, EPFO submitted a detailed counter affidavit in the court, highlighting that there’s no rule for accepting retrospective contribution to the Provident Fund. They argued that the attempt by 67 employees to get pension on their actual salary at such a later stage, isn’t legally sustainable.

During the court proceedings, the Single Judge issued an interim order requiring CIAL to provide a demand draft (DD) for the requisite sum, which CIAL complied with. Subsequently, the Single Judge through an impugned judgment, disposed of the W.P.©, directing the appellants to encash the DD deposited by CIAL towards alleged deficiency and arrears. They were also ordered to issue a letter detailing the alleged arrears, including records of the employees and other office registers maintained in the office, including the EPF numbers assigned to them.

Additionally, it was mandated that after reviewing these documents, if any further deficiencies are identified, EPFO must send a demand after calculating the amounts and take action as outlined in Sections 7Q and 14B of the EPF Act.

CIAL paid Rs 78.14 lakh in the demand draft (DD). Out of this amount, only Rs 13.24 lakh is the employer’s contribution.

Out of the Rs.78.14 lakh, the employer’s contribution due is just Rs 13.24 lakh, while the balance Rs 65 lakh is the interest on the EPF shortfall from 1995 to 2022.

EPFO has appealed to a larger bench of the Kerala High Court. On July 21, 2025, EPFO won the case.

Kerala High Court said this about retrospective application for higher pension

The Kerala High Court in its judgement dated July 21, 2025 said that the primary question to be considered is whether, without determining the money due from the employer as envisaged under Section 7A, the Single Judge could have directed CIAL to produce a DD towards the purported deficiency and arrears and then proceed to direct the EFPO to encash the same and undertake a computation as envisaged under Sections 7Q and 14B.

Also read: EPS 95 Pension: Madras HC allows higher EPS pension for post-Sept 1, 2014 retirees under this condition

The Kerala High Court said that it is not in dispute that CIAL had limited the contribution to both the provident fund and the pension fund to the statutory limit till June 6, 2003. Even as per the EPFO, there was no deficiency or shortfall in the remittance of the contribution towards the provident fund by CIAL.

The Kerala High Court said the 67 employees have already superannuated and have received the emoluments that follow without demur. It is the specific contention of the EPFO that the EPF scheme stipulates that, if so desired, the employer and the employee could jointly opt for making contributions on the actual salary, which is higher than the ceiling limit of the salary in terms of para 26.6 of the EPF Scheme, 1952.

It would be relevant to reproduce paragraph 26.6 of the EPF Scheme, 1952, as it stands now:

“Notwithstanding anything contained in this paragraph, an officer not below the rank of an Assistant Provident Fund Commissioner may, on the joint request and writing of any employee of a factory or other establishment to which the scheme applies and his employer, enroll such employee as a member or allow him to contribute on more than Rs 15,000/- of his pay per month if he is already a member of the fund and thereupon such employee shall be entitled to the benefits and shall be subject to the conditions of the fund provided that the employer gives an undertaking in writing that he shall pay the administrative charges payable and shall comply with all statutory provisions in respect of such employees.”

Also read: Higher EPS pension can’t be denied to members retiring after September 1, 2014, once EPFO accepts higher wage contributions, Kerala High Court

Kerala HC: For getting higher pension a joint request for contributing more than the statutory limit is needed

The Kerala High Court said that paragraph 26.6 of the EPF Scheme, 1952 envisages a joint request for contributing more than the stipulated amount, as well as an undertaking in writing from the employer for opting to make contributions on the actual salary, which is higher than the ceiling limit of the salary.

As regards to the 67 employees, there had been no joint request with CIAL for payment of contributions on higher wages by complying with the procedure as stipulated under para 26.6 of the EPF Scheme, 1952.

The employees never exercised the option to pay, nor actually paid the higher contribution on their actual salary exceeding the wage ceiling. They, who are no longer members of the pension fund, and have already superannuated and as of now are termed by EPFO as not to be ‘employees’ as envisaged in the Pension Scheme, had all along been aware of the fact that the employer’s share of contribution, is restricted to the statutory ceiling and had accepted the EPF and the pension fund benefits as per their entitlement without protest. Neither respondents 1 to 67 nor the CIAL has produced any evidence to prove the contrary.

The Kerala High Court said that it is in the above context that the contention put forth by the EFPO that the amount of benefits and the rate of contributions under the pension fund scheme are regulated based on the actuarial valuation becomes relevant.

As regards the retrospective contributions that are now being offered, the Kerala High Court said that they find merit in the contention of EPFO that it never had any advantage of receiving this contribution, which, if at all chosen to pay, could have been paid years back, complying with the due procedure as explained above.

The Kerala High Court said that EPFO, would now, under the impugned judgment, be required to bear the burden (due to the single bench judgement), in case any payouts are to be made, without having had the benefit of the relevant amounts for actuarial investments earlier.

Kerala High Court said: “It is exactly for the said reason that the EPF Act does not provide or contemplate any retrospective contribution to the provident fund or the pension fund. The provision for contributing to the provident fund above the statutory limit under Para 26.6 of the EPF scheme 1952 is available to the employees only, and that too with prospective effect when the wages of the employee exceed the stipulated sum.”

The Kerala High Court said they have noted that this aspect had not engaged the attention of the Single Judge.

Ext.P1 series would indeed reveal that the CIAL had been writing to the 2nd respondent Regional Provident Fund Commissioner, from 2018 onwards and had been persistent up till 2020 with their request to accept retrospective contributions concerning their retired employees.

However, the same by itself is not a substitute for the procedure envisaged in para 26.6 of the EPF Scheme, 1952 or its present equivalent.

It would also be relevant to note that the Ext.P1 series issued by the CIAL refers to W.P. (C) No.1320 of 2015 and the connected cases, regarding which the EPFO had profusely mentioned in its counter affidavit that the matters touching the issue at hand are under active consideration of the Hon’ble Supreme Court.

The contentions put forth based on Ext.P5 series produced as part of Annexure R1 (b), which is the “Specimen consent of Majority of employees for voluntary coverage under the EPF Act, 1952”, also does not constitute a compliance with the mandates of para 26.6 of the EPF Scheme, 1952 or its current equivalent.

The counsel for the respondents had relied on a footnote in Ext.P5 series produced as part of Annexure R1 (b), which mentions that the relevant detail needs to be incorporated in the document only if ‘retrospective coverage is desired’ and attempts to contradict the contention of the EPFO that retrospective coverage is never envisaged in the EPF Act.

Kerala High Court said: “The said contention, however, is bound to fail as the footnote in the form cannot be a substitute, nor can it override the Act or the Scheme. The dictum laid down by the Hon’ble Supreme Court in Pavan Hans Limited (supra), in a comparable though not similar context, is relevant.”

An extract of the Supreme Court Pavan Hans Limited judgement read as follows:

“Provident Fund is normally managed on actuarial basis; the contributions received from employer and the employee are invested and the income by way of interest forms the substantial fund through which any payout is made. For all these years the Fund in question was subsisting on contributions made by the other employees and, if at this stage, the benefit in terms of the judgment of the High Court is extended with retrospective effect, it may create imbalance. Those who had never contributed at any stage would now be members of the fund. The fund never had any advantage of their contributions and yet the fund would be required to bear the burden in case any payout is to be made. Even if concerned employees are directed to make good contributions with respect to previous years with equivalent matching contributions from the employer, the fund would still be deprived of the interest income for the past several years in respect of such contributions. ( Emphasis supplied)

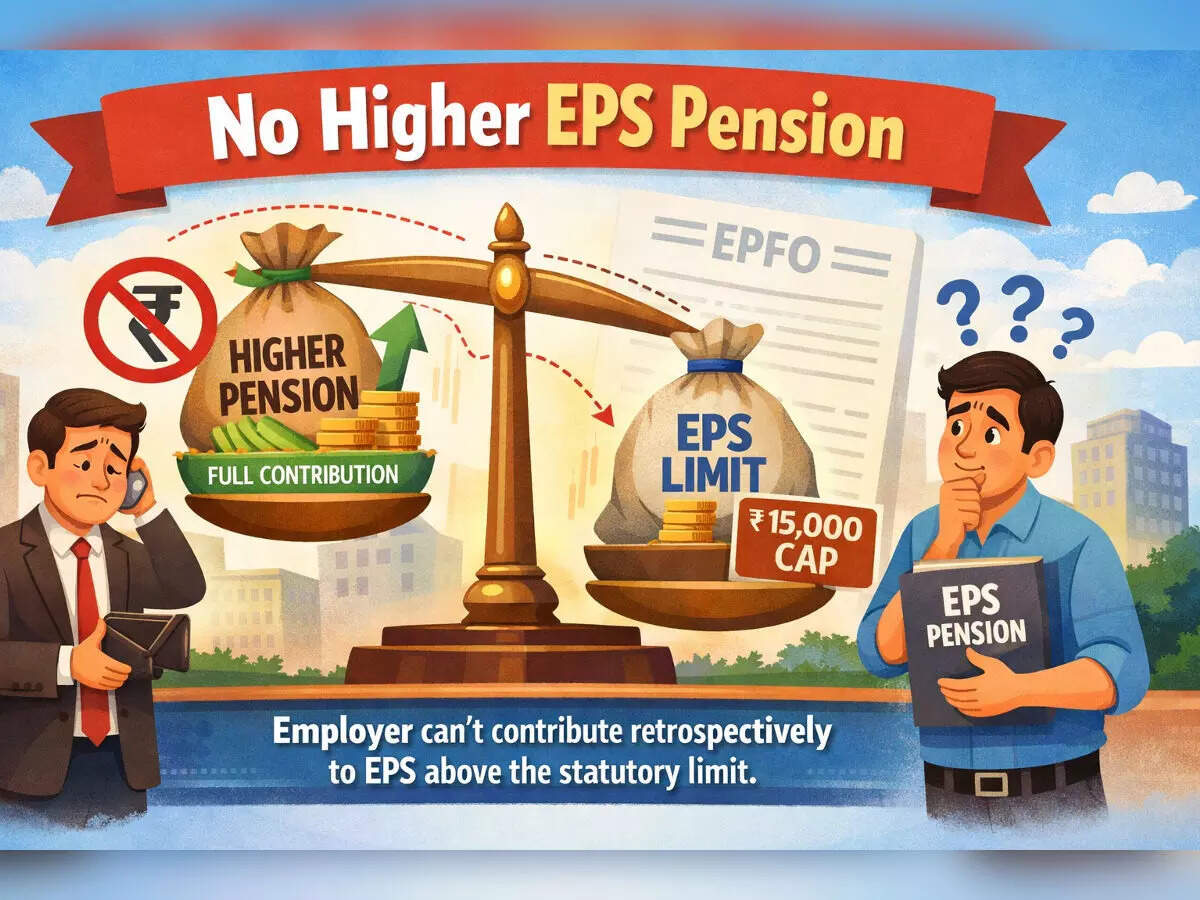

Kerala HC: Employer can’t contribute retrospectively to the pension fund more than statutory limit

The Kerala High Court said that it is trite that the employer cannot contribute retrospectively to the pension fund more than statutory limits just to derive benefits which were not available to the members when the contribution was limited to statutory wages.

As regards the reliance placed on the dictum in Jose v. Thomas (supra), the Kerala High Court said that they note that in the said case, the prayer was to quash the order of rejection issued by the EPFO, which had been produced as Ext.P3 therein.

Thus, in Jose v. Thomas judgement, the employer had moved the EPFO requesting to permit them to deposit the arrears towards the employer’s contribution to the EPF account with retrospective effect on the actual salary and the said prayer had been rejected by the EPFO. In the case at hand, however, there is no rejection or even consideration of the request preferred by CIAL. Hence, the dictum in Jose v. Thomas (supra) does not assist the case of respondents 1 to 67 (employees).

We (Kerala High Court) see merit in the submission of the learned counsel for the appellants that the learned Single Judge could at the most have directed consideration of the representation of CIAL rather than directing production and encashment of the DD.

The Kerala High Court said that a direction to process the matter further as per Sections 7Q and 14B of the Act without a determination first under Section 7A could not have been made. Unless a determination of the money due from the employer as envisaged in Section 7A of the EPF Act is carried out by the EPFO, the question of accepting the amounts unilaterally arrived at by the employer and produced vide a DD before the court does not arise.

Kerala High Court judgement

The Kerala high Court noted that the Employees Provident Fund was envisioned with the avowed object of making some provision for the future of the employee after he retires or in case of his early death to provide for his dependents.

It is necessary to ensure that the EPF scheme remains financially sustainable. Providing the guaranteed benefits is crucial for both employee security and the long-term viability of the fund.

Kerala High Court said: “Vested social security rights of the employee vis-à-vis the provident fund has to be harmonised with the health of the fund.” Affecting retrospective contributions and seeking payment of pension on the said basis has the propensity to burden the funds and to unsettle its actuarial basis.”

The Kerala High Court said that determination of the money(s) due from the employer under Section 7A and issuance of an order calling upon the employer after quantification is a sine qua non for receiving deficiency or arrears from the employer.

Judgement:

- In the total absence of any legal norms that permit retrospective coverage, the learned Single Judge had erred in directing the CIAL to produce a DD for the alleged deficiency of contribution for the period 1995 to 2003 and in directing the appellants EPFO to encash the said DD and undertake the computation as envisaged under Section 7Q and 14B of the Act.

- In the light of the above, the judgment dated 28.03.2022 in W.P.(C) No.7801 of 2020 of the learned Single Judge is set aside.

- The appellants are hereby directed to treat Ext.P1 series or any other representation, if any, that the CIAL may submit and consider the same in accordance with law and as per the mandates of the EPF Act.

- This appeal is allowed as above. No costs.