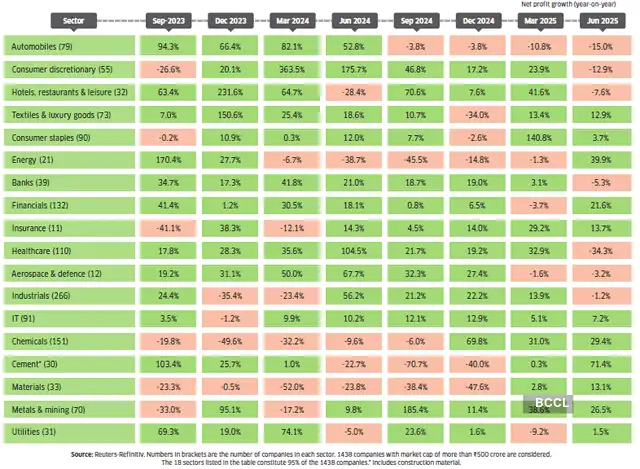

Cement, energy and metals drive modest profit growth

Persistent demand challenges weighed on India Inc. in Q1 2025-26, with the aggregate net profit of 1,438 companies (market capitalisation above Rs.500 crore) rising just 6.4% year-over-year—the weakest growth in three quarters. Quarter-on-quarter earnings fell 7.6%.

Three sectors drove this modest performance: cement (boosted by higher volumes and lower variable costs), metals (aided by healthy realisations and cheaper coking coal), and energy (supported by strong marketing margins and increased gas volumes). Excluding these, the remaining companies posted flat earnings (-0.08%).

Banking struggled with weak momentum, high credit-deposit ratios, and margin compression. The Information Technology (IT) sector showed mixed signals—healthy order books offset by concerns about structural demand and macroeconomic uncertainties. Consumer staples faced margin pressure due to high-cost inventory, although stable rural-urban demand provided some support.

Despite the softness, 54.7% of the 320 tracked companies beat analyst estimates, indicating a favourable beat-to-miss ratio.