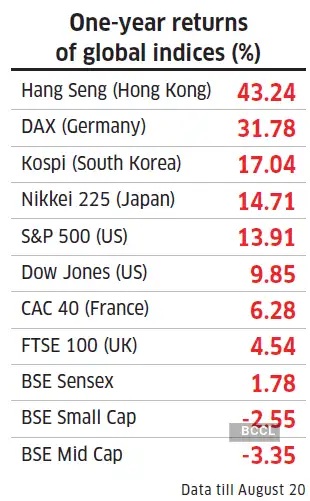

However, many investors were unable to take advantage of the rally in global stocks, as the mutual fund route had remained largely closed due to restrictions on overseas investments by Indian asset management companies. The Reserve Bank of India (RBI) has imposed a $7 billion industry-wide cap on mutual fund investments in overseas securities. An additional $1 billion limit is available specifically for investments via exchange-traded funds (ETFs). Both of these limits are nearly exhausted.

A route that remains open for overseas investments is Outward Remittances under the Liberalised Remittance Scheme (LRS) for resident individuals.

LRS is a facility introduced by RBI that allows Indians to freely remit up to $250,000 per financial year for certain permitted transactions, which include overseas education, travel & tourism, medical treatment and investment in shares, mutual funds, debt instruments, and real estate outside India.

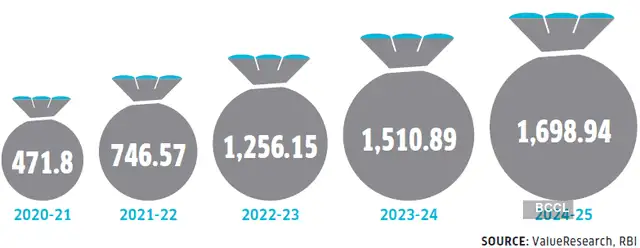

RBI data shows that investment in equity or debt via the LRS route jumped 12.45% year-on-year (y-o-y) to $1.70 billion in 2024-25.

While you can directly invest in global ETFs and stocks via fintech platforms that have tie-ups with global exchanges, resident investors can also invest through GIFT City using the LRS avenue. “Just look at last year’s returns of the Indian market, and the asset allocation strategy will tell you that you cannot have all your money invested in one place. So for diversification, you may also check out the GIFT City route,” says Vaibhav Shah, Head-Products, Business Strategy & International Business, Mirae Asset Investment Managers (India).

What is GIFT City?

GIFT City (Gujarat International Finance Tec-City) is India’s first International Financial Services Centre (IFSC), designed to be a global financial and technology hub. It offers a unique and attractive environment for various types of investors, both Indian residents, NRIs (Non-Resident Indians), and foreign entities.

The International Financial Services Centres Authority (IFSCA) has been vested with the combined regulatory powers of India’s four domestic regulators for banking, capital markets, pension funds, and insurance to oversee IFSCs in the country.

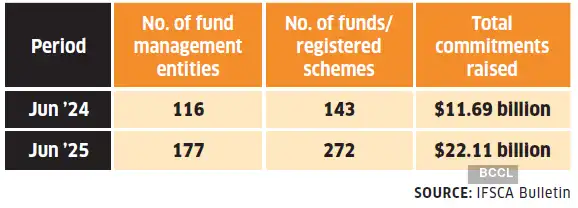

Notably, of the total investments made via GIFT City, around 85%of investments have been directed towards India. We look at the investment opportunities in GIFT City for resident Indian investors.

Retail funds

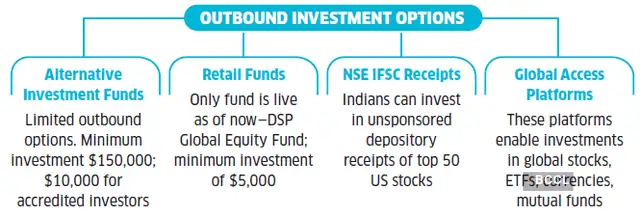

While there are 177 Fund Management Entities (FMEs) having licences or registrations in the GIFT City, only one retail-focused fund is open right now.

DSP IFSC, a unit of DSP Asset Managers, recently launched the DSP Global Equity Fund — the first retailfocused offshore fund to be rolled out from GIFT City.

The fund will be country- and benchmark-agnostic, with 25-30 stocks, having a soft minimum threshold of $30 billion in market capitalisation. “Unlike many mutual funds that invest pan-global, DSP Global Equity Fund will be underweight on the US with an allocation of around 25%. A major part of the investment will be focused on Asia (Korea, Taiwan, Japan, Hong Kong) and Europe (Sweden, Germany, France, Italy and the UK),” says Jay Kothari, Global Head-International Business, DSP Asset Managers.

The fund has a minimum lump sum investment of US $5,000 with an incremental top-up of US $500. The fund house is also planning to launch the SIP route soon.

While the registration for the fund is currently a physical and digital journey, DSP IFSC plans to go completely digital in the next few days.

GIFT your portfolio global access

It enables investments by both resident Indians and NRIs, though 85% of the funds have been directed towards India.

COST BENEFIT

Nil Securities Transaction Tax, Commodity Transaction Tax, and Stamp Duty

BUSINESS HIGHLIGHTS

There are two stock exchanges, India INX and the NSE IFSC, operating out of the GIFT City, which enable residents of India to invest in global securities.

Currently, under the LRS route, resident Indians can invest in NSE IFSC receipts, which are classified as unsponsored depository receipts (UDRs). There are 50 stocks selected out of S&P 500 index listed as UDRs on the NSE exchange platform at GIFT City.

“They are not actually ownership stocks. These UDRs represent ownership of shares in US companies, which allow Indian investors to trade in foreign stocks without directly holding them. For example, one can even buy fractional stocks of companies such as Apple,” says Naveen Mathur, Director, Anand Rathi International Ventures IFSC.

Why global diversification is important

Many investors missed the global stock rally due to investment restrictions on mutual funds, but LRS remains open for overseas investments.

Meanwhile, IFSCA has already given permission to add 75 stock listings as UDRs. According to Mathur, there are also plans to launch exchange-listed products, which would provide global access to over 100 markets to Indian investors.

Resident investors can also access 135 global stock exchanges through GIFT City– registered brokers, that act as global access providers similar to fintech platforms like Vested Finance.

Viram Shah, co-founder of Vested Finance, which is in the process of launching operations in GIFT City, said, “Another route for overseas investments that will come up is global ETFs listed on the offshore exchanges. Further, we will soon have IPOs of Indian companies in the GIFT City.”

Investment trends in global equity and debt via LRS ($ million)

To be sure, the global investment route is currently open via the LRS route through the conventional channel as well. “However, Indians may prefer the GIFT City route for direct overseas investment now because it offers peace of mind, as this investment is a regulated product offered by an Indian regulator,” said Shah. Further, unlike Indian stock transactions, you don’t pay Securities Transaction Tax (STT), Commodity Transaction Tax (CTT), or GST on most IFSC trades.

Alternative funds

It is one of the largest investment categories at GIFT City, with 272 Alternative Investment Fund (AIF) schemes registered. Outbound funds in GIFT City, such as the Mirae Asset Global Allocation Fund (Close-Ended Fund Category III AIF), open up international opportunities not available through the mutual fund route, which is limited by RBI-imposed restrictions. Note that these AIFs have a minimum investment threshold of $1,50,000 and $10,000 for accredited investors.

While there are many funds investing in GIFT City investing in India, not many options are available on the outbound front. “There is a very strong interest from Indian investors to invest in international markets. However, GIFT City has its own challenges,” said Rohit Beri, Co-founder and Chief Investment Officer of ArthAlpha, a PMS, which is exploring setting up GIFT City operations.

According to Beri, the tax treatment of outbound funds is not on par with Global IFSCs. “If you are investing via Singapore, you pay tax only when you redeem the fund, but in GIFT City, the tax is charged in the hands of AIF as and when AIF sells a security, making it tax inefficient for the resident Indians,” he said. Meanwhile, GIFT City is treated as an “offshore” investment for Indian Income Tax purposes even though it’s within India.

“Capital gains from selling shares, mutual funds, bonds, or debentures in GIFT city by resident Indians via the LRS route are subject to the same provisions and rules which are applicable generally on all regular investments,” says Mayank Mohanka, Founder, Taxaaram India and Partner, SM Mohanka & Associates. Long term capital gains are taxed at 12.5 % and STCG is taxable at 20 %.

Should you invest?

Keep in mind that resident Indians need to do a separate KYC process with entities registered in the GIFT City to be able to invest via this route. Also, note that remittances for investments exceeding Rs.10 lakh in a financial year made under the LRS are liable for a 20% TCS. This is also applicable to the GIFT City. One of the major attractions of GIFT City is that investors’ end-goals could be in foreign currency, and they’re trying to hedge the currency risk.

“Further, as a jurisdiction, GIFT City feels less unfamiliar compared to going and investing through Singapore or through some other jurisdictions. Also, local mutual fund options to invest internationally have become fewer because of the RBI’s cap on foreign investments,” says Vishal Dhawan, CEO of Plan Ahead Wealth Advisors, a wealth management firm in Mumbai.

While a strong point in favour of GIFT City is familiarity with the location and jurisdiction, experts suggest continuing to use the conventional LRS route for overseas investment and diversification as it offers a greater number of options to resident Indians. “Over time, as the GIFT City becomes more established and the range of options becomes widespread, that’s wheninvestors may want to explore going to the GIFT City rather than using LRS directly,” said Dhawan.