The swap auction is done by the RBI to tackle the persistent deficit seen in the banking system since mid December. The daily average deficit in system liquidity in March stood at Rs 1.6 lakh crore, RBI data showed.

“There was more demand in the auction, and the higher premiums show that people are willing to pay more to swap their dollars,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank.

Agencies

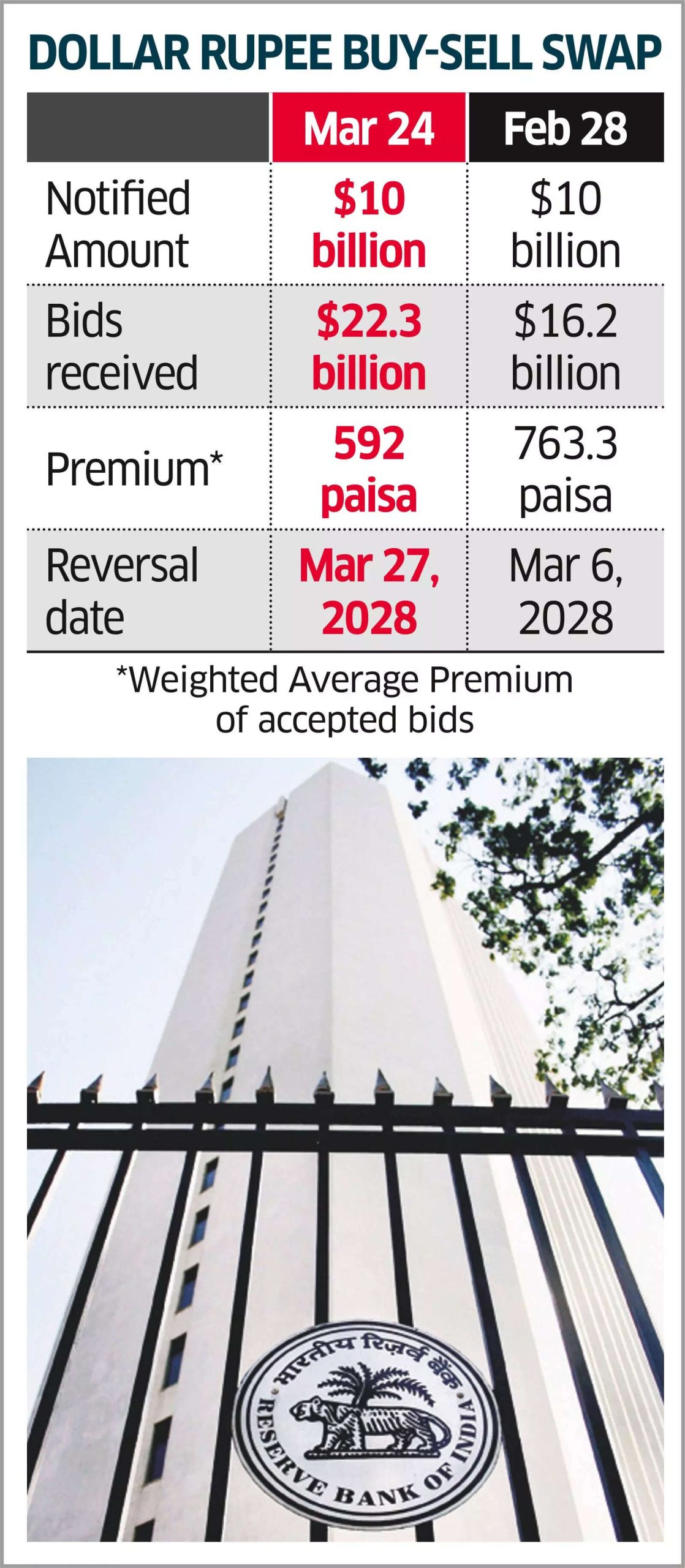

AgenciesEven though the premiums for Monday’s swap auction were higher than market expectations, they were lower than the premiums of the previous auction which happened on February 28. At that time, the average premium of accepted bids stood at 673 paisa.

“Since this is the second long term $10 billion auction, the premium is lower than last time. Lower premiums are good for the markets,” said Gopal Tripathi, head of treasury at Jana Small Finance Bank.

In the buy-sell swap, the RBI buys dollars in exchange for rupees, hence infusing liquidity into the system. In the second leg of the transaction in March 2028, the RBI will sell back the $10 billion to the market at the forward rate, which is the currency exchange spot rate at that time, plus 592 paise