Geopolitical tensions, volatile crude prices, and uncertainty around Fed rate cuts will continue to weigh on market sentiment. In such an environment, it’s prudent to focus on stocks that can withstand these headwinds. One effective strategy is to look for companies with high capital efficiency, which can help optimise both risk and returns.

Capital efficiency can be defined as the ability of an organisation to use resources to maximise output (products, revenue or profits). In other words, capital efficiency indicates how well a company converts its capital into growth and shareholder value. Stocks that improve capital efficiency are better positioned to maintain margins and profitability in volatile market conditions.

Return ratios are often used for evaluating the capital efficiency of a company, with return on equity (RoE) as a key metric for identifying good quality companies. It measures how much a company earns on its equity capital and is calculated by dividing the annual net income, or profit after tax (PAT), by the average equity capital. For example, a company with a RoE of 20% means that it is generating a net profit of Rs.20 on every Rs.100 invested by the shareholders.

An increasing RoE over time means that the company is generating shareholder value by reinvesting its earnings in quality projects that are contributing to profits. Such companies also enjoy scalable business models, pricing power, customer loyalty and their share prices can compound returns over time. On the other hand, a declining RoE could indicate reinvestment of capital in unproductive assets.

RoE widely varies across industries due to diverse capital structures

Naren Agarwal, CEO and Partner, Wealth1, explains that RoE is among the most critical metrics in equity research, especially for long-term investors assessing capital efficiency. It strips out the impact of size and capital structure. Two companies may report similar profits, but the one generating those profits with less equity—and thus a higher RoE—is fundamentally more efficient.

What influences RoE?

While RoE can help investors identify companies that create value over the long term,it is important to ensure that an improvement in the metric is backed by real cash flows and not accounting gimmicks. High debt levels can also inflate RoE, but this comes at the cost of increased solvency risk. RoE can be dissected using profit margins, asset efficiency and leverage. Such dissection can be studied through a DuPont model, which calculates RoE by multiplying the three factors. The DuPont model checks if a company has better margins, improved asset turnover, or strategically uses debt.

For instance, a company with high operating margins and a strong asset turnover is fundamentally sound, while one depending heavily on leverage may have a fragile RoE foundation.

Manish Goel, Founder and MD, Equentis Wealth Advisory Services, explains that higher net income directly pushes RoE up, while lower profits drag it down. On the other hand, asset efficiency assesses the quality of assets by maximising utilisation and minimising idle resources. The third component, leverage, can boost returns, but excessive debt introduces significant risk and can severely impact a company’s financial health.

RoE differs across industries due to the diverse capital structures and asset intensities. Industries characterised by high RoE, such as software, branded consumer goods, and specialised manufacturing, tend to exhibit high profit margins and require minimal capital investment. Conversely, capital-intensive or heavily regulated industries, such as utilities, telecommunications, food production, and traditional manufacturing, generally exhibit lower RoE.

Vipul Bhowar, Senior Director & Head of Equities-Listed Investments at Waterfield Advisors says that comparing a company’s RoE with that of its industry peers facilitates a more accurate contextual understanding of its performance, rather than relying on an arbitrary benchmark.

RoE counterparts

Experts believe that although RoE is an important snapshot of shareholder returns, it should never be viewed in isolation. “Important complementary metrics are Return on Assets (RoA), which eliminates the impact of leverage; debt-to-equity, which provides information on financial risk; and free cash flow, which reveals actual cash generation. By integrating RoE with these metrics, shareholders can take informed and well-rounded stock decisions,” says Sachin Jasuja, Founding Partner-Head Equities, Centricity.

In addition, RoE when paired with DuPont analysis, provides key insights about the business fundamentals. “True value lies not in high RoE per se, but in understanding how it is earned — and whether it can endure,” adds Agarwal.

Data supports expert views

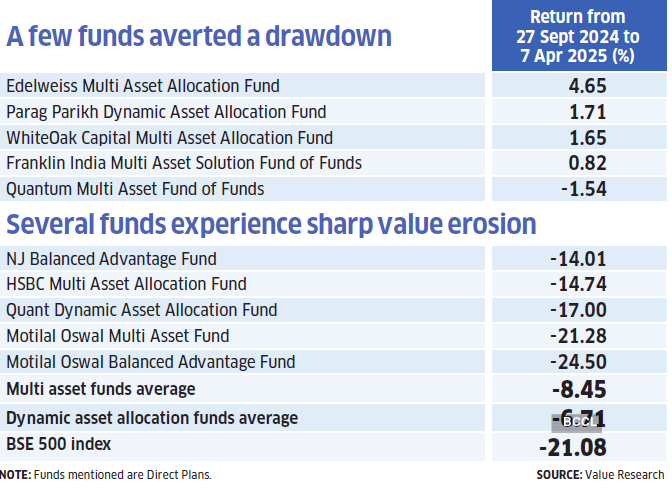

An analysis of RoE data for 2,092 non-financial companies (market cap over Rs.100 crore) over the past five financial years, up to 2024-25, shows that 70 companies have consistently improved their RoE each year and have doubled it between 2020-21 and 2024-25. Data is compiled from Reuters-Refinitiv.

Top bets

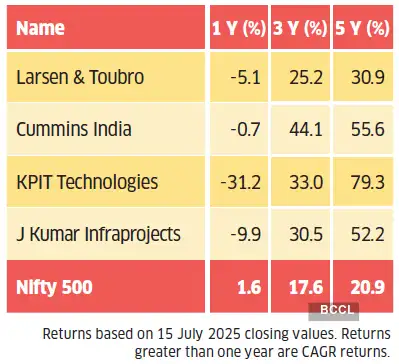

These 70 companies generated an equalweighted average return of 22.5%, 61.3%, and 55.8% over the past one, three, and five years, respectively. In comparison, the Nifty 500 index returned 1.6%, 17.6%, and 20.9% over the same period. Returns beyond one year are annualised. The analysis is based on closing values as of 22 July 2025.The group of these 70 companies has also shown resilience during the market downturn. Between October 2024 and March 2025, the BSE 500 tanked 13.2% whereas the these 70 companies generated an average return of -8.7% during the period. While 19 companies generated positive returns during the period, 38 companies (54%) outperformed the Nifty 500 index.

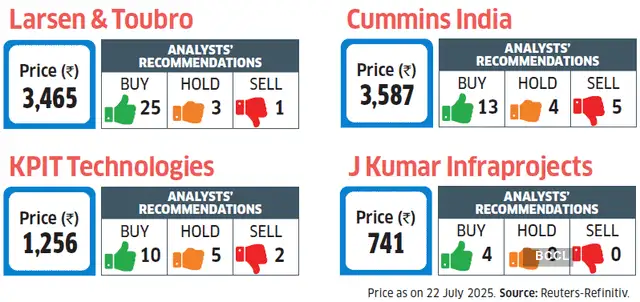

Among the 70, here are four companies with reasonable analyst coverage and a moderate debt-to-equity ratio.

Stock price returns

Larsen & Toubro

- The heavy industry and engineering company is expected to report a revenue and PAT growth of 13.8% and 20.9% respectively on a year-on-year basis in the June 2025 quarter, as per Reuters-Refinitiv estimates.

- A pickup in order inflows and stable working capital in the capital goods space will aid the performance.

- The dominant position in the domestic engineering, procurement and construction (EPC) segment, diversified revenue profile, in-house design and engineering capabilities created a strong competitive position for the company.

- The financial position is robust, aided by steady debt and a strong cash balance. Its order book is well-diversified across sectors and geographies, which helps in mitigating credit risk. Moreover, the rising revenue share of IT and Technology Services has also helped to contain working capital requirements.

- A recent rating rationale note from ratings agency CRISIL believes that L&T will maintain its leadership position in the EPC segment and is positioned to benefit from the infrastructure spending in India over the medium term. Also, its profitability is expected to be stable, supported by the increasing contribution of the IT business.

Cummins India

- The manufacturer of diesel and natural gas engines is expected to report a revenue and PAT growth of 11.7% and 2.3% respectively in the June 2025 quarter on a year-on-year basis, according to Reuters-Refinitiv estimates.

- Steady performance of the domestic business is expected to aid the performance during the quarter.

- The management guided (after the March quarter earnings) for a doubledigit revenue growth for 2025-26.

- Segment-wise, the industrial segment will see strong momentum from contributions from the railways and construction sectors. On the other hand, the domestic powergen segment will be driven by strong demand from residential, commercial, infrastructure, and emerging verticals such as quickcommerce, warehouses and data centres.

- The distribution segment is benefitting from long-term contracts, value-added services, and aftermarket support.

- Analysts believe that strong domestic demand, recovery in exports, cost optimisation and product innovation are the key growth levers.

KPIT Technologies

- The software solution provider for the mobility and automotive industry is expected to report revenue growth of 12.6% and a PAT decline of 2.2% on a year-on-year basis in the June 2025 quarter, according to Reuters-Refinitiv estimates.

- It reported strong deal wins in the March 2025 quarter across Europe, Asia and the US region. The management acknowledged demand uncertainty in the current financial year; however, the large deal wins are expected to scale up once the uncertainty settles down.

- The management is focusing on future growth through partnerships with Chinese OEMs (Original Equipment Manufacturers) and expansion into adjacent verticals like commercial vehicles and off-highways segments. It also aims to maintain margins through productivity gains from investments in artificial intelligence and automation.

- It is deepening engagement with clients by offering electrification, autonomous technologies and services in cybersecurity, end-to-end validation and semiconductors.

J Kumar Infraprojects

- The construction and infrastructure development company is expected to report revenue and adjusted PAT growth of 13.5% and 10.9% respectively on a year-onyear basis, according to HDFC Securities estimates.

- The order book of `22,240 crore (at the end of March 2025) provides decent revenue visibility. The management is expected to bid projects across sectors (NHAI projects, water projects and metro projects in Pune, Thane, Mumbai and Delhi) in the current financial year.

- Benefit from increased government infrastructure spending and a pickup in road project awards. Management has guided for 15% revenue growth in 2025-26. Additionally, operational efficiencies are likely to support EBITDA (earnings before interest, taxes, depreciation and amortisation) margins over the next few quarters.

- The gross debt remains rangebound, aided by healthy internal accruals. The balance sheet is robust and expected to support future growth.