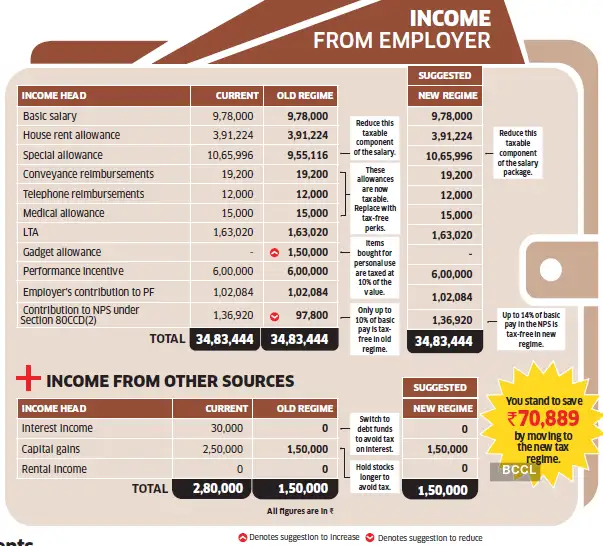

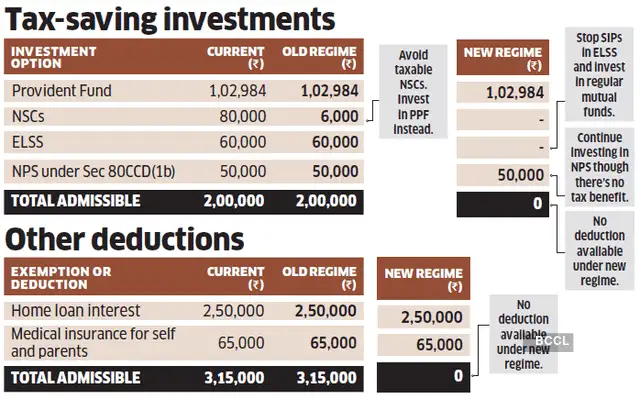

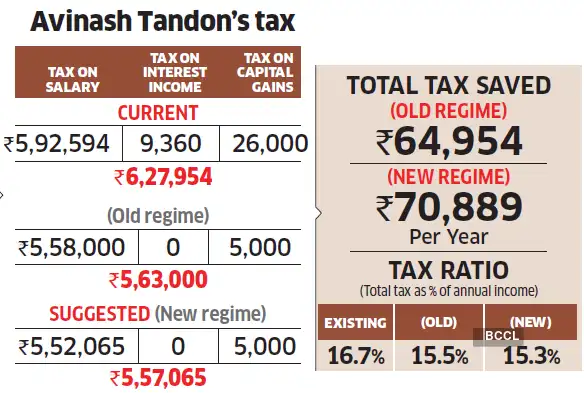

However, he will save more if he shifts to the new tax regime. The new regime offers no deductions and exemptions, but the standard deduction is higher at Rs.75,000, and tax slabs are wider, with lower rates. Even if no deductions are available, there is room for tax savings. He is already contributing 14% of his basic salary to the NPS, which is tax-free under the new regime (10% of basic salary under the old regime), and he should continue with it.

He has also invested about Rs.4 lakh in fixed deposits and NSCs (National Savings Certificates), and earns an interest of Rs.30,000 on these. To save tax, he should switch from these investments to debt funds or arbitrage schemes. While the interest income is taxed every year, in debt and arbitrage funds it is applicable only at the time of withdrawal. This can reduce his tax liability by Rs.9,400.

Tandon has also made long-term capital gains of Rs.2.5 lakh from stocks and equity funds. Regular harvesting of capital gains to remain within the tax-free limit of Rs.1.25 lakh can help reduce tax incidence.

Hence, he can reduce his overall tax by more than Rs.70,000 by shifting from the old to the new tax regime.

WRITE TO US FOR HELP

Paying too much tax? Write to us at etwealth@timesofindia.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.