This provision can also be used if you make a mistake in calculations, forget to include some income source, or need to rectify any other kind of omission or error in your tax return.

Time limit

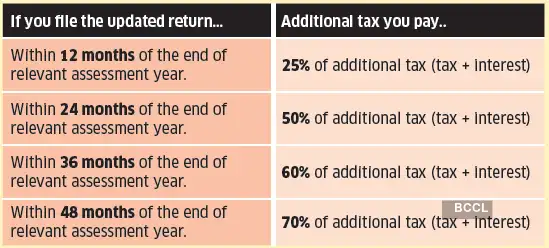

You can file updated returns within four years of the end of the relevant assessment year. So, if you miss the original due date of 31 July (this year it is 15 September) for filing returns and even miss the deadline for filing belated or revised returns (31 December), then for the assessment year 2025-26, you can file updated returns till 31 March 2030.While you have the advantage of being able to file updated tax returns, you are also liable to pay additional tax depending on when you file the tax return during the four-year window.

Changes you can’t make in ITR-U

You cannot file an updated return under Section 139 (8A) if…

- You are claiming or increasing r amount.

- You are showing a lower tax liability.

- You are showing losses in the return.

- If assessment/ revision is pending or completed.

- If a survey has been conducted under Section 133(A).

- If an updated return is already filed.

- If a search is initiated against Section 132.

- If accounts, assets, or documents have been seized under Section 132A.