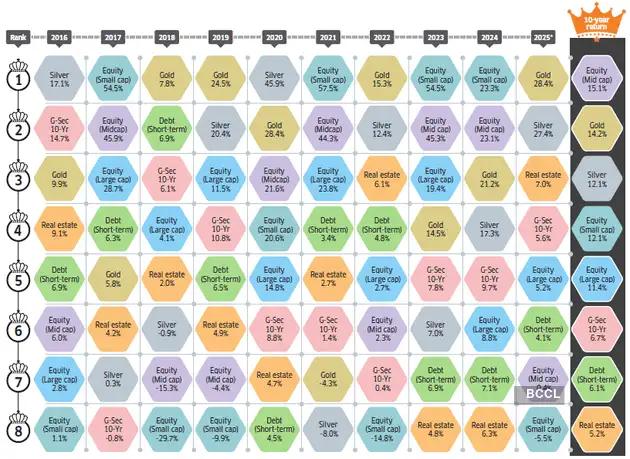

Mid-caps and gold lead long-term gains

The demand for safe-haven assets amid global uncertainty fuelled gold prices, while strong industrial demand and limited domestic supply supported silver’s surge in 2025.

Mid cap and small cap segments turned laggards due to the absence of fresh growth triggers, elevated valuations, profit booking, and shifting investor sentiment, particularly among foreign portfolio investors (FPIs). Currently, mid and small-cap benchmarks are trading at over a 40% premium to the Nifty 50, based on historical price-to-earnings multiples. In the long run, equity mid-caps led the performance charts, driven by their faster earnings growth, and expansion into new markets. Gold was a long-term diversifier due to its low correlation with equities and resilience against macro-economic shocks such as rising oil prices and geopolitical tensions.

Source: Reuters-Refinitiv, NHB and ACE MF. *2025 data is YTD based on 19 August 2025 closing values. Other years’ returns are calculated between the first and the last trading day closing values. 10-year return is compounded average return. NHB Residex returns based on March values for each year. The latest NHB Residex data is available up to the March 2025 quarter. Benchmarks used: Equity (Large cap): Nifty 50, Equity (Midcap): Nifty Midcap 100 Index, Equity (Small cap): Nifty Smallcap 100 Index, Silver: MCX Silver futures, Gold: MCX Gold futures, G-Sec 10-Yr : Crisil 10 Yr Gilt Index, Debt (Short-term) : Crisil 91 Day T-Bill Index, Real Estate : NHB Residex.