It is important to note this PayLater feature closure information especially if you have activated ICICI Bank PayLater for recurring payments like Netflix, etc since the bank said the payments won’t be honoured once the feature is closed. Hence the reason why you should switch to an alternative payment option before ICICI Bank discontinues the PayLater feature.

Read below to know more about what ICICI Bank said and what customers of the bank should do about it.

What did ICICI Bank say about PayLater (credit line on UPI?

According to the public notice by ICICI Bank, here are the details:

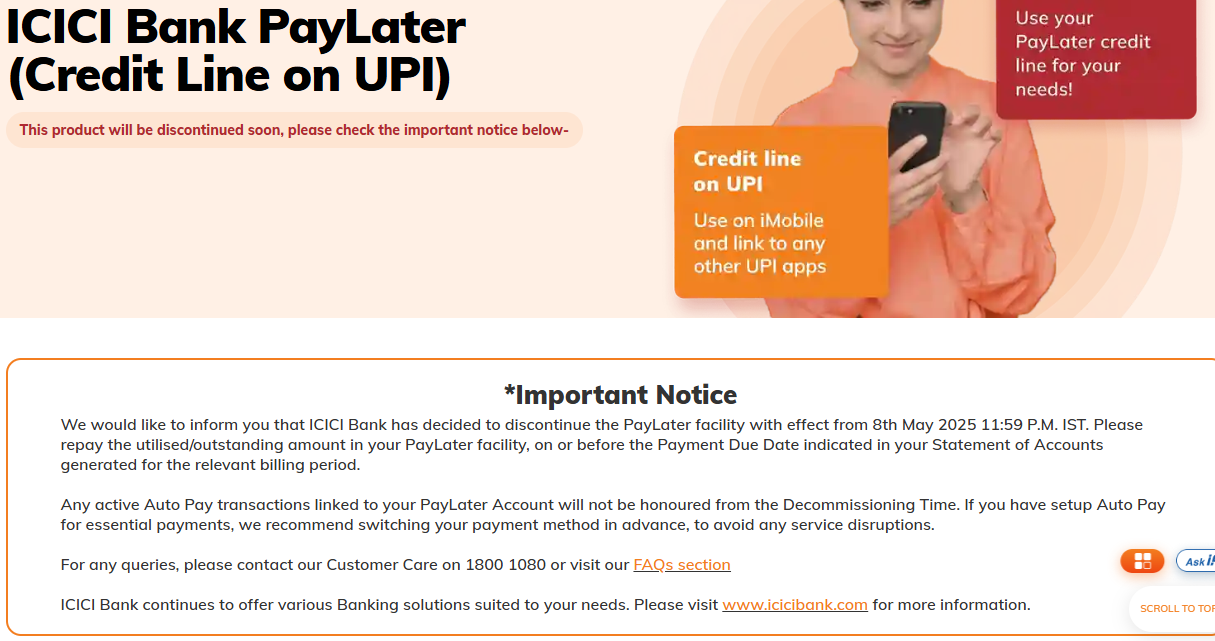

- We would like to inform you that ICICI Bank has decided to discontinue the PayLater facility with effect from 8th May 2025 11:59 P.M. IST. Please repay the utilised/outstanding amount in your PayLater facility, on or before the Payment Due Date indicated in your Statement of Accounts generated for the relevant billing period.

- Any active Auto Pay transactions linked to your PayLater Account will not be honoured from the Decommissioning Time. If you have set up Auto Pay for essential payments, we recommend switching your payment method in advance, to avoid any service disruptions.

ICICI Bank credit line on UPI

Source: https://www.icicibank.com/personal-banking/paylater

What should customers with ICICI Bank PayLater do?

To help the customers deal with this closure information about PayLater, ICICI Bank has released some frequently asked questions (FAQ).FAQs:

Q1. What is ICICI Bank PayLater facility?

Answer: ICICI Bank PayLater is a Credit Line on UPI. Customers can check their offer eligibility under the ‘Get Instant Loans/Offers’ section on iMobile Pay. Customers can also check the eligible offers through Net Banking in the ‘Offers’ section and avail the required offers.

Q2. Why is ICICI Bank discontinuing the PayLater facility?

Answers: ICICI Bank is discontinuing the PayLater facility as per its internal policy revisions from 8th May 2025 11:59 P.M.

Q3. What will happen to my pending dues?

Answer: All outstanding dues must be cleared as per the existing repayment schedule, either through Auto Debit or the iMobile app/Retail Internet Banking. Late payments will attract penalties, as per the PayLater Terms & Conditions. Post clearance of all the dues, the bank will close your PayLater account.

Q4. What will happen to the Auto Pay transactions linked to my PayLater facility?

Answer: All Auto Pay transactions linked to your PayLater Account will be disabled from 8th May 2025, 11:59 P.M. IST Please update your payment method at the earliest for uninterrupted services.

Q5. Will this impact my credit score?

Answer: There will be no impact on your credit score if you clear all outstanding dues on time. Delayed payments may affect your credit history.

“The discontinuation does not mean the outstanding dues are waived — users are still liable to repay the amount within the billing cycle, failing which interest, penalties, and credit score repercussions may follow,” says Ekta Rai, Advocate, Delhi High Court.

Along with paying dues on time, customers should also take note of discontinuing their recurring payments, like monthly subscriptions, which were linked to their PayLater account. Although the PayLater service is no longer active, any outstanding balance remains a legal liability. This negative balance will continue to be treated as credit availed from the bank.

“ICICI may continue to levy interest and applicable late fees on unpaid amounts. Moreover, the unpaid dues will be reported to credit bureaus, potentially lowering your credit score. A low credit score can reduce your eligibility for future loans, credit cards, or even rental agreements and employment in finance-related roles. It can also lead to higher interest rates on approved loans,” adds Soayib Qureshi, Partner, PSL Advocates & Solicitors.

On the other hand, if you have surplus funds lying in this account, withdrawing them might not be so simple, since this is not a typical savings account.

“Given that this is not a regular savings account, users can’t just withdraw those funds directly. I’d strongly recommend reaching out to the bank for clarity or requesting a transfer to a primary account to avoid confusion or potential forfeiture,” explains Rai.

Qureshi highlights that direct withdrawal is not available via UPI or ATM channels for this account type. If your PayLater account shows a positive balance, the amount may be refunded to your linked savings account upon request. Users should contact ICICI Bank’s customer care or visit a branch to initiate the refund process.