You can claim the Section 87A tax rebate both under the old and the new tax regimes, and by doing so, your net tax liability can drop to zero. For FY 2024-25 (AY 2025-26), you claim the Section 87A tax rebate for income up to Rs 7 lakh under the new tax regime. For FY 2025-26 (AY 2026-27), you can claim Section 87A tax rebate for income up to Rs 12 lakh under the new tax regime.

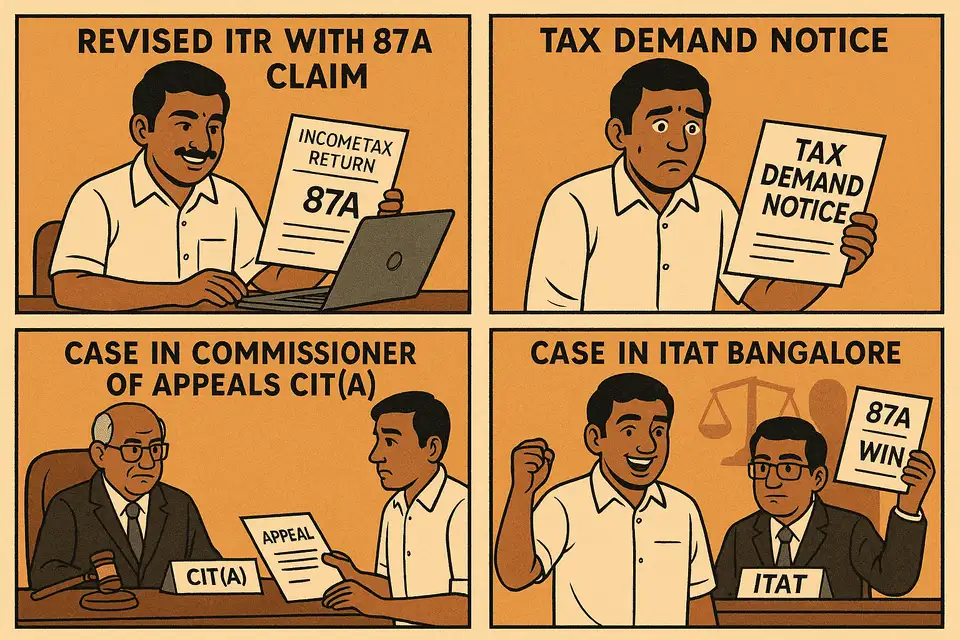

Check out the details below to see how T. Jakkarraju won this case and what the ITAT Bangalore had to say:

How did this case start?

According to the order of ITAT Bangalore dated June 30, 2025, here are the brief facts of the case:

- The brief facts of the case show that the assessee (T. Jakkarraju) filed the original return of income (ITR) on June 22, 2024 which was processed on June 30, 2024 at the same income.

- Subsequently on July 11, 2024, assessee (Jakkarraju) revised its return of income (ITR) which was processed on September 24, 2024 claiming rebate under Section 87A of Rs 21,350.

- In the intimation, the above Section 87A rebate was denied. Aggrieved with the same, assessee (T. Jakkarraju) preferred before the ld. CIT(A).

What did Jakkarraju’s lawyers say before ITAT Bangalore?

Jakkarraju’s lawyers said:

- The ld. AR submitted that assessee (T. Jakkarraju) has failed to claim tax rebate under the provisions of Section 87A which is an error and omission in the original return of income and therefore revision of return is proper.

- He further submitted that even in the new regime or old regime, there is no difference in the claim of rebate under Section 87A of the Act.

- He referred to the provisions of section 115BAC to show that relief under Section 87A is available in both the regimes and therefore rejection of return of income of the assessee (T. Jakkarraju) claiming such rebate is not proper. He further submitted that the provisions of section 143(1)(a) also do not refer to the adjustment on account of relief under Section 87A of the Act. Therefore, the order of the ld. CIT(A) is not valid.

Also read: After STCG ruling, now LTCG also allowed to get Section 87A tax rebate, rules ITAT Chennai

Section 87A tax rebate

What did ITAT Bangalore say about Section 87A tax rebate?

The Vice President of ITAT Bangalore– Prashant Maharishi, said in the order dated June 30, 2025:

- We have carefully considered the rival contentions.

- The facts show that the assessee (T. Jakkarraju) filed the original return of income (ITR) claiming benefit under the old regime on June 22, 2024. It was processed u/s. 143(1) on June 30, 2024.

- There is no adjustment under that intimation. However, the assessee subsequently has filed a return of income (ITR) on July 11, 2024 wherein assessee (T. Jakkarraju) claimed rebate under Section 87A of the Act amounting to Rs 21,350.

- This was processed on September 24, 2024 and it was denied to the assessee.

- The ld. CIT(A) held that as held by the Hon’ble Supreme Court in the case of CIT v Wipro Ltd., revised return cannot be filed to convert the original return into loss return in the absence of any omission or mistake.

- I find that the above judgment does not apply to the facts of the present case for the reason that there is error and omission in the original return of income of not claiming rebate under Section 87A of the Act.

- I find that this issue is covered by the decision of the Hon’ble Bombay High Court in the case of Chamber of Tax Consultant v. DGIT (System) [2025] 473 ITR 85 wherein the claim under Section 87A is allowed. In view of the above decision of the Hon’ble Bombay High Court, assessee is entitled to rebate u/s. 87A of the Income Tax Act, 1961.

- Accordingly, I direct the ld. AO to allow rebate under Section 87A to the assessee amounting to Rs 21,350.

- Accordingly, the appeal of the assessee is allowed. Pronounced in the open court on this 30th day of June, 2025.

Also read: No income tax for lady who sold land for Rs 4.5 crore; Know how a 1955 circular and established case laws saved the day for her

Chartered Accountant Praksh Hegde says: “In this order, the Honourable Income Tax Appellate Tribunal (ITAT) has held that if a taxpayer fails to claim the rebate under Section 87A in the original Income Tax Return (ITR), it can be claimed by filing a revised ITR. The ITAT reasoned that since the claim was not made in the original ITR, it constitutes an “error or omission,” thereby satisfying the prerequisite for filing a revised ITR.”