EPF

This government-backed scheme is available only to salaried employees in an organisation registered with the Employees’ Provident Fund Organisation (EPFO). Any company with more than 20 employees has to register with the EPFO and offer this deposit scheme to its employees.

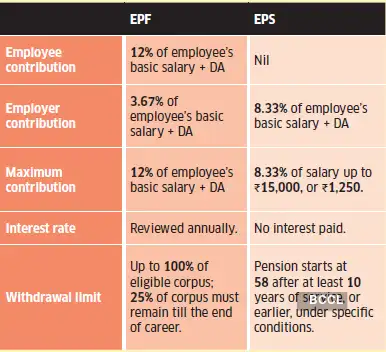

Both the employee and employer contribute 12% of the salary (basic and dearness allowance) to the fund. The employer’s share is split, with 3.67% going into the fund, and the remaining into the EPS. The rules for withdrawal of the EPF corpus have recently been changed (see page 10).

How the two schemes differ

The EPF currently offers an interest rate of 8.25% (2024-25), and this is reviewed every year. The contribution to the EPF qualifies for deduction under Section 80C up to Rs.1.5 lakh in the old regime, while the interest income is tax-free up to Rs.2.5 lakh a year. The withdrawals are tax-free only under specific conditions.

EPS

This is a pension scheme that is aimed at providing a steady income in retirement only to the members of the EPF. The pension starts at 58 years after at least 10 years of service.

Only the employer contributes to this pension scheme, not the employee. The employer’s contribution is 8.33% of the employee’s salary (basic + dearness allowance).

Even on the employee’s death, the pension continues to be paid to the nominee.