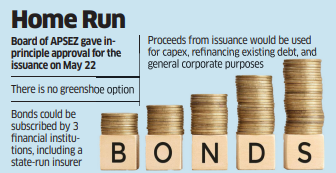

The issue opens for bidding on May 29. There is no greenshoe option, keeping the total size capped at ₹5,000 crore. Market insiders said the bonds would be subscribed by three financial institutions, including a state-run insurer.

Proceeds from the issuance would be used for capital expenditure, refinancing existing debt, and general corporate purposes.

Agencies

AgenciesJPMorgan Chase CEO Jamie Dimon advocates for taxing carried interest, aligning with Donald Trump’s efforts to close the loophole benefiting private market investors. Dimon suggests using the additional revenue to double income tax credits, benefiting communities and families. He also cautioned about a potential “crack in the bond market” due to government overspending and quantitative easing.

As of March 31, 2025, APSEZ’s net debt stood at ₹36,422 crore. With Ebitda at ₹20,471 crore, its net debt-to-Ebitda ratio stood at 1.78x, improving from 2.3x at the end of FY24.

An Adani spokesperson did not immediately respond.

“This is the largest bond issuance by APSEZ in terms of size,” the banker cited above said. “Adani is opting for a longer tenor as the funding requirement is long-term in nature.”The board of APSEZ gave in-principle approval for the issuance on May 22. The papers are rated Crisil AAA.APSEZ, India’s largest private port operator, has a cargo handling capacity of 633 million metric tonnes and handled 450 MMT in FY25. Its portfolio includes 15 domestic ports/terminals and four global assets across Israel, Tanzania, Australia, and Sri Lanka.

On April 17, 2025, the company announced acquisition of Abbot Point Port Holdings (APPH), Singapore-which owns the entities that own and operate North Queensland Export Terminal (NQXT)-from Carmichael Rail and Port Singapore Holdings, Singapore.