Gratuity is not part of CTC as it is calculated on the basis of the last-drawn basic pay, DA and the years of service. However, the basic pay is part of CTC. So, if an employer keeps the basic pay of an employee high, the gratuity amount of an employee at the time of exit will rise.

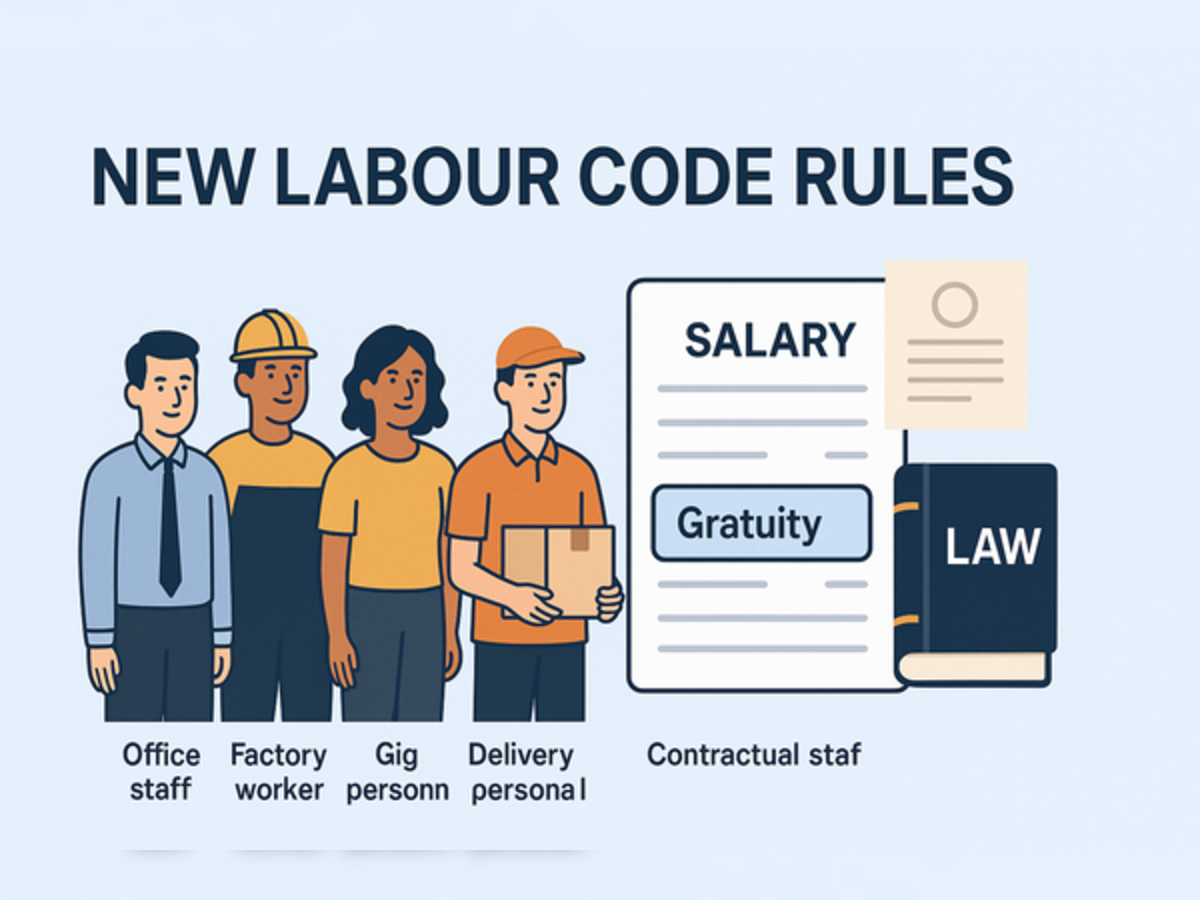

An employee becomes eligible to get gratuity after 5 years of service in most cases. However, under new labour codes, the government has reduced the duration to 1 year for fixed-term and contractual workers.

Also read: New Gratuity Rules 2025: 4 things salaried employees must know about updated Labour Code guidelines

What is the wage for calculating benefits and social security contributions under the new labour code?

Under the new labour code, the “wage” for calculating Employees’ Provident Fund (EPF), gratuity, bonus and other benefits of an employee will include:

- Basic salary

- Dearness allowance (DA)

- Retaining allowance (if applicable)

All other payments like HRA, special allowance, travel and incentives are treated as allowances.

What does the labour code say about gratuity?

According to a Press information Bureau (PIB) release on Labour Code 2019, released on November 23, 2025, “For the purpose of calculation of benefits and social security contributions, the redefined wage includes basic pay, dearness allowance and retaining allowance. In case allowances and contributions exceed over 50% (as may be notified by the Central Government) of the total payment, the excess amount shall be added to the wage. Social security contributions and benefits (like PF, gratuity, maternity benefits and bonus) will be based on a larger and fairer portion of pay, resulting in higher future benefits.”

Also read: New labour codes explained: 10 types of employees who will benefit immensely from revised rules

What is gratuity?

Gratuity is a statutory benefit governed by the Payment of Gratuity Act, 1972. It is a financial incentive given by an organisation to its employees in appreciation of their long-term contributions to the company. It serves as a monetary token of gratitude for an employee’s years of commitment and devotion. The amount is disbursed when an employee retires, resigns, or separates from the organisation, offering a financial cushion for the next phase of life.

Gratuity payouts are determined based on the Payment of Gratuity Act, 1972. As per Section 4(2) of the Act, gratuity payable is equal to the last-drawn monthly wage×15/ 26×completed years of service.

Also read: New Labour Law 2025 salary calculator: Here’s how CTC of Rs 7 lakh, Rs 10 lakh and Rs 15 lakh will change

New Gratuity Rules: 4 things to know

1. Gratuity service year eligibility reduced to 1 year for fixed-term employees

The central government has reduced the minimum service period for fixed-term employees to be eligible for gratuity. Earlier, five years of continuous service was mandatory to qualify for gratuity. Under the new rules, fixed-term employees become eligible after just one year of continuous employment, making the benefit far more accessible.

2. Contract workers to get gratuity benefits similar to permanent employees

Principal employers are now responsible for providing social security coverage, including gratuity, to contract staff engaged through contractors.

3. Contract workers to get gratuity after 1 year of service

For contract workers too, the government has reduced continuous service years from 5 to 1 as the eligibility to get gratuity.

4. Gratuity extended to export sector fixed-term workers

Fixed-term employees in the export sector will also come under the gratuity framework. In addition to gratuity, they will be entitled to provident fund (PF) and other social security benefits.