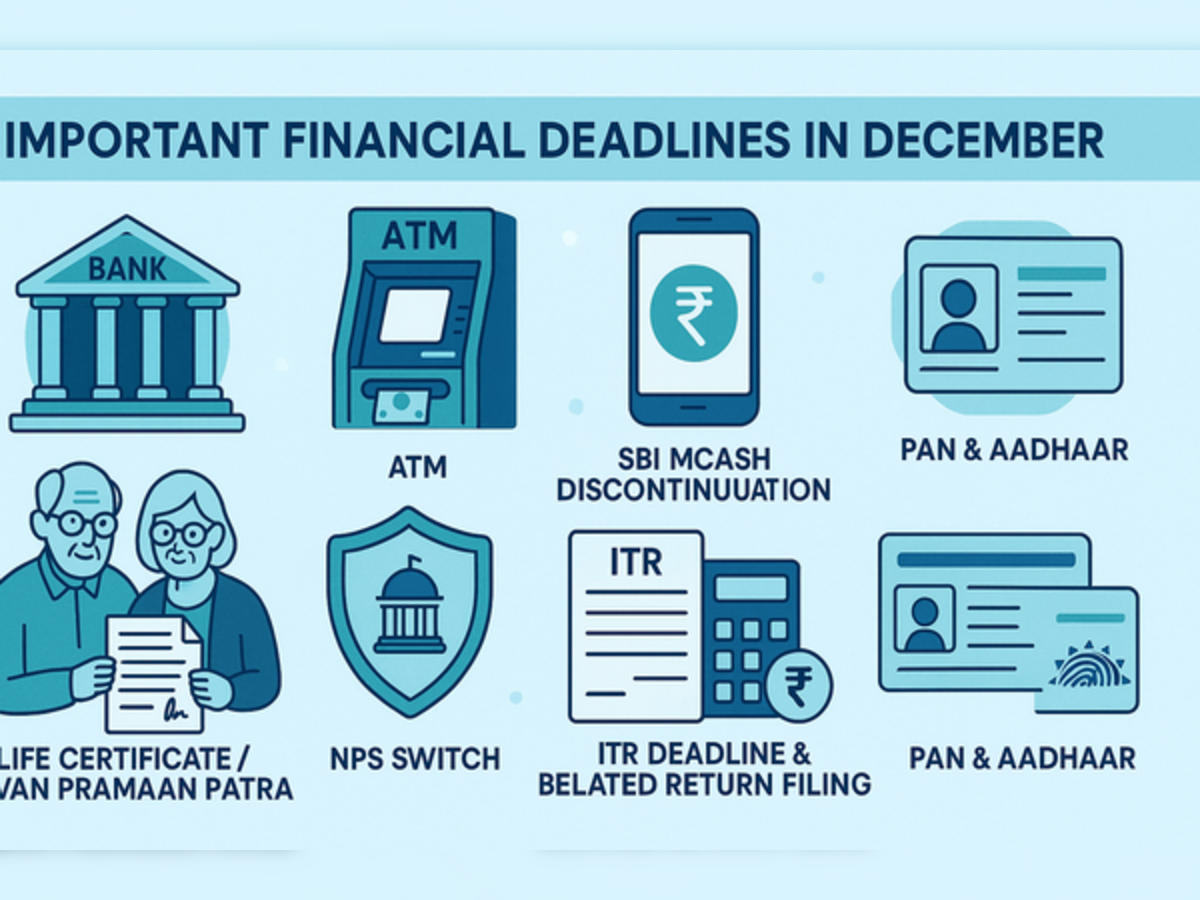

SBI to discontinue its SBI mCash service

State Bank of India (SBI) will discontinue the mCASH sending and claiming facility on OnlineSBI and YONO Lite after November 30, 2025. This means customers will no longer be able to use mCASH to send money without beneficiary registration or to claim funds through the mCASH link or app once the service is discontinued.

In its message posted on its official website, SBI has urged customers to switch to other secure and widely used digital payment options—such as UPI, IMPS, NEFT, and RTGS—for transferring money to third-party beneficiaries.

Last date to submit life certificate (Jevaan Pramaan Patra)The deadline to submit a life certificate for government pensioners to continue receiving pension is November 30, 2025. Jeevan Pramaan Patra, or Digital Life Certificate (DLC), is a biometric-enabled Aadhaar-based digital certificate for pensioners. Individual pensioners can generate their Jeevan Pramaan Patra, i.e, DLC, using their Aadhaar number and biometrics.

Deadline to switch from NPS to UPS

The deadline to exercise the option to switch from National Pension System (NPS) to Unified Pension Scheme (UPS) is November 30, 2025. All NPS subscribers interested in switching to UPS are advised to submit their request either online through the CRA system or by filing a duly filled physical application with their respective Nodal Office on or before the due date.

UPS offers several key benefits, including the switch option, tax exemptions, and enhanced provisions for resignation and compulsory retirement, among others. All eligible central government employees and past retirees under NPS are encouraged to apply within the timeline to avail these advantages. Importantly, those opting for UPS will still retain the flexibility to switch back to NPS later, should they wish to do so.

December 10 ITR deadline for tax audit cases

The Central Board of Direct Taxes (CBDT) extended the due date of furnishing of return of income under sub-Section (1) of Section 139 of the Act for the Assessment Year 2025-26, which is October 31, 2025 in the case of assessees referred in clause (a) of Explanation 2 to sub-Section (1) of Section 139 of the Act, to December 10, 2025.A belated Income Tax Return (ITR) is essentially a return filed after you’ve missed the original deadline. Filed under Section 139(4) of the Income Tax Act, it gives taxpayers a second chance to stay compliant, though it may attract certain penalties. For FY 2024–25, you can still file a belated return, but only until December 31, 2025.

PAN – Aadhaar linking deadlineThe Income Tax Department has extended the deadline to December 31, 2025 to link their PAN with Aadhaar card for anyone who received their PAN using an Aadhaar enrolment ID before October 1, 2024.