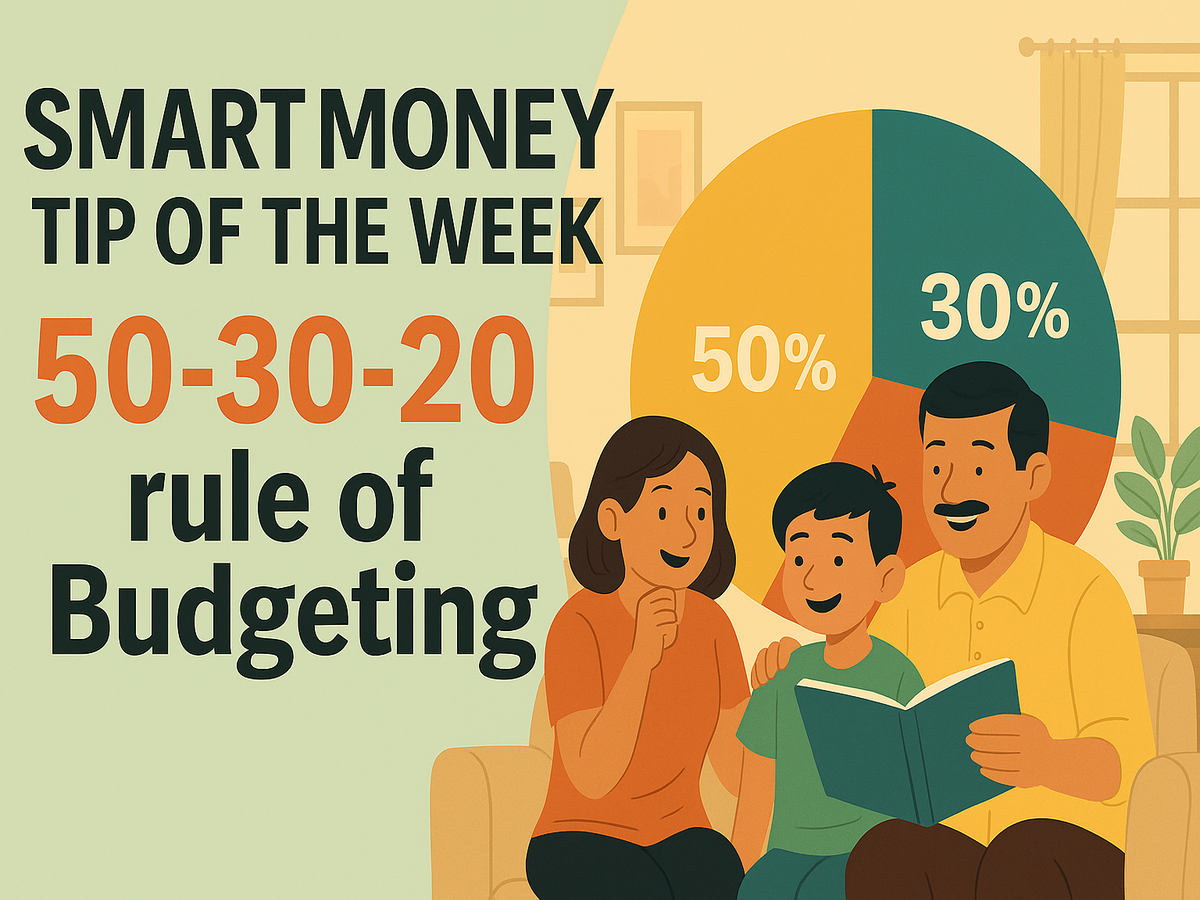

It is essential to strike a good balance between our current needs and future requirements. The amount of money required for future life goals like retirement is so much that it cannot be accumulated during a short period of time and needs dedicated long-term planning. This is where the 50-30-20 rule can come in handy. It does not matter how much money you earn. This thumb rule can be used to guide you on how much to save and spend in a month.

Also read | Smart investment: How can you get Rs 1 lakh monthly passive income

What is the 50-30-20 rule of Budgeting?

The 50-30-20 rule is very simple to follow: You divide your monthly income into three parts.

50% of the income goes towards essential needs.

30% of the income goes towards wants and lifestyle expenses.

And the remaining 20% of the income goes towards savings and investments.

What fits into each category

The needs category can include rent, groceries, utilities, regular transport costs, school fees and basic medical expenses. These are expenses that cannot be postponed.

The wants category includes eating out, shopping, travel, entertainment, subscription services and other lifestyle choices. These are things that improve comfort but are not necessary for day-to-day functioning.

Savings and investments include contributions to your emergency fund, SIPs, retirement planning, insurance premiums and other long-term financial goals.

How to use the 50-30-20 rule?

Let us understand how to use the 50-30-20 rule for various income levels.

| Income – Rs 30,000 | Income – Rs 75,000 | Income – Rs 1,50,000 | |

| Needs | Rs 15,000 | Rs 37,500 | Rs 75,000 |

| Wants | Rs 9,000 | Rs 22,500 | Rs 45,000 |

| Savings and investments | Rs 6,000 | Rs 15,000 | Rs 30,000 |

How increments in income can help you save more

The 50-30-20 rule becomes more effective when you receive increments. You can make the most of an increment by keeping your needs and wants at the same level and directing a larger share of the increase towards savings. Let’s understand this with the help of examples:

| New income – Rs 33,000 | New income – Rs 82,500 | New income – Rs 1,65, 000 | |

| Increase | Rs 3,000 | Rs 7,500 | Rs 15,000 |

| Needs | Rs 16,500 | Rs 41,250 | Rs 82,500 |

| Wants | Rs 9,900 | Rs 24,750 | Rs 49,500 |

| Savings and investments | Rs 6,600 | Rs 16,500 | Rs 33,000 |

Saving should get the highest priority among all the three categories as it will help you manage other two constituents accordingly without compromising with your saving target. For instance, once you have invested 20% of your income and then find your needs going beyond 50%, then you will have the scope to reduce your lifestyle expenses accordingly in that month to make sure your monthly budget is not derailed.

However, if essential expenses have not changed much over time, you can divert most of the increment to long-term investments. Even saving an extra Rs 1,500 a month after an increment can grow significantly through compounding. This is one way to raise your savings rate gradually without affecting your lifestyle. Over a few years, this habit can greatly accelerate your wealth creation.

50-30-20 rule road to financial independence

The 50-30-20 rule can act as a strong starting point to achieve financial freedom. For those who want to achieve financial independence, increasing the savings portion above 20% can make a significant difference. Small increases in the savings ratio can dramatically improve long-term wealth, especially once compounding begins to take effect.

However, the ideal split may vary for Indian households. Rent in metro cities, family responsibilities and home loan EMIs can sometimes push needs above 50%. In such cases, the rule can still work as a guideline rather than a strict formula. The idea is to maintain balance and prevent lifestyle spending from quietly taking over your income. While your income may significantly grow with time, your expenses may not necessarily grow in proportion to the rise in income. It is advisable to step up your savings and investments with each rise in income to achieve financial independence.

The biggest strength of the 50-30-20 rule is that it introduces structure into your monthly finances. Even if you fail to follow the percentages perfectly, you can use the rule as a framework to understand where your money goes and how much you can realistically save. Over time, the habit of dividing your income into needs, wants and savings can bring stability and reduce money-related stress, especially for young earners who are just beginning their financial journey.